As the uncertainties in EU region rise, sell EUR/USD?

Dollar’s turning point may only arrive in the first two quarters of next year

The rising dollar trend may have room to run with the Fed expected to continue raising rates into 2019. This means that the US currency may remain strong well into the coming few months. It will do best against currencies with more exposure to China, such as Australia and New Zealand.

With the US economy still running hot, a tightening labour market and a Fed that’s unlikely to give any hint that they are approaching peak rates for several quarters, dollar bears have plenty of hurdles to clear. The turning point may only arrive during the end of the first half of next year when political risk bubbles up again around US government spending. Furthermore, the US midterm election results may stymie additional fiscal stimulus measures. A pause in Fed rate hikes sometime around the middle of 2019 and the start of rate increases in Europe should also be factored in. Hedge funds and other speculators boosted net long positions on the dollar by 27,904 contracts to 300,479 in the week which ended on November 6, according to data from the Commodity Futures Trading Commission. It’s the largest bullish position since January 2017. Speculators extended their short bet on the euro by 14,181 contracts to 46,843, the largest bearish stance since March 2017. Net short positions on the CAD shrunk by 7,023 contracts to 2,632, the smallest bearish stance since positioning flipped from bullish in March.

US producer prices rose more than forecast in October, the biggest jump in six years with broad gains in costs for goods and services, data showed last Friday. The producer price climbed 2.9% from a year earlier after a 2.6% gain. The figures, which measure wholesale and other selling prices at businesses, indicated that price pressures in the production pipeline are advancing steadily. Along with solid demand, the tariff war with China has raised concern that producers will face rising prices and supply chain disruptions for raw materials. The Federal Reserve on Thursday reiterated its plan to keep lifting interest rates gradually.

The US Secretaries of State and Defense met with their Chinese counterparts for an annual strategy session in Washington on Friday, with both sides highlighting deep differences on diplomacy and security weeks before Presidents Donald Trump and Xi Jinping plan to meet at a summit in Argentina. US Secretary of State Mike Pompeo said that the Trump administration hopes to work with China to reduce imports of Iranian oil now that the US is re-imposing sanctions after Trump’s withdrawal from the 2015 nuclear deal.

Our Picks

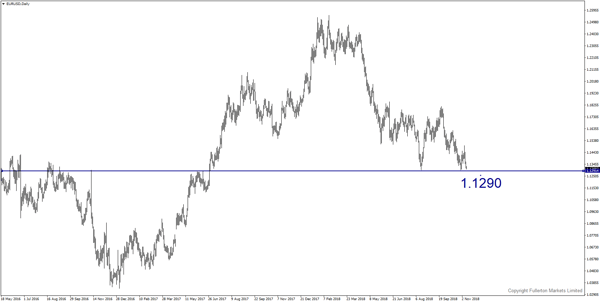

EUR/USD – Slightly bearish.

Bearish momentum growing in this pair. EUR/USD may fall below 1.30 towards 1.1290 this week.

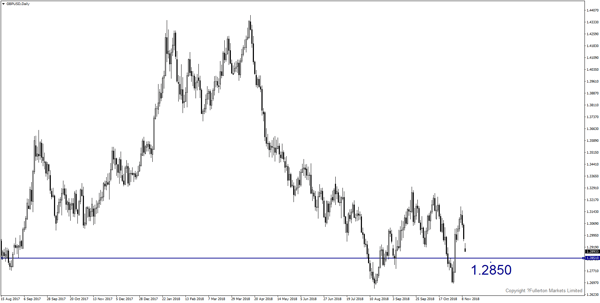

GBP/USD – Slightly bearish.

The rise in concern that May will fail to get her plan through Parliament as her Conservative Party lacks a majority. This pair may drop towards 1.2850 this week.

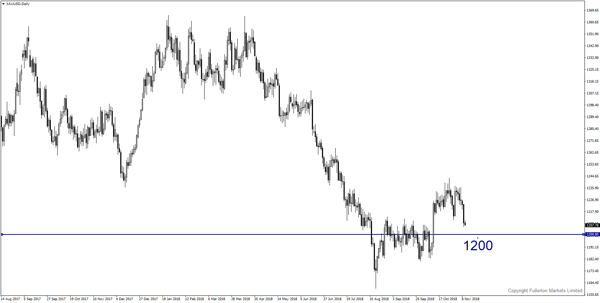

XAU/USD (Gold) – Slightly bearish.

We expect price to fall towards 1200 this week.

Fullerton Markets Research Team

Your Committed Trading Partner