Aussie dollar may not have bottomed yet as production capacity in China remains low

China’s economy has been running at just 40-50% capacity in the last weeks, with large variations across sectors. This may continue to weigh on the Aussie dollar, one of the proxies to gauge the Chinese economy.

In the absence of reliable and high-frequency data, we base our estimate on the best available numbers, a close reading of the news, and conversations with contacts across the country. The picture that emerges points to downside risks to an already-bleak forecast for Q1 growth.

Daily transport numbers showed that passenger volumes since 31 January have been 85% below 2019 levels, suggesting a large fraction of migrant workers has yet to return to work after the extended Lunar New Year holiday. Foreign exchange trading volumes and copper output suggest that businesses might be running at 50% capacity. Medical supply firms – where production would be prioritised during a virus outbreak – and centrally managed state-owned enterprises which have more resources to mobilise, set high watermarks. Available data suggest that they’re above 75% of capacity.

Our initial scenario analysis pointed to China’s growth slowing to 4.0% year on year in Q1. An economy operating at 40-50% capacity for two weeks, and gradually returning to normal, would pose downside risks to that scenario. According to data from the Ministry of Transport, the average number of people travelling per day by any means – such as road, rail, water and air – between 31 January (the first day after the usual Spring Festival holiday) and 17 February was between 11 million and 14 million – around 15% of the 2019 level.

In China’s cities, a large portion of people headed back to their hometowns for the Lunar New Year break. For major cities, such as Beijing and Shanghai, this can be as high as around 50% of the workforce. Putting these two sets of data together suggests that 40-50% of people in the workforce may not have returned to the city where they work by 15 February. Many of those were likely subjected to quarantine, further reducing staff availability. Across manufacturing and services, the staff crunch is likely to be particularly acute for smaller and private firms, as they tend to have a higher reliance on migrant workers.

UK’s resilient economy and less political uncertainty may continue to support GBP

The UK economy extended a run of better-than-expected growth in February, more evidence of a rebound after fourth-quarter stagnation. While the expansion continued apace, there were also signs of a hit to supply chains from coronavirus, according to IHS Markit’s flash purchasing managers index.

The election of a majority government and Britain’s exit from the European Union on 31 January ended four years of Brexit-related uncertainty. Political stability is keeping the pound steady, while rate-cut bets and falling hedging costs are luring borrowers. For investors, the ability to earn between 60 and 235 basis points over UK borrowing costs, depending on the tenor, is the main attraction.

Our Picks

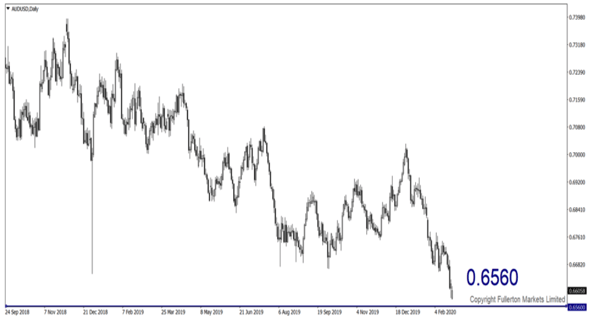

AUD/USD – Slightly bearish

This pair may drop towards 0.6560 this week.

GBP/USD – Slightly bullish

This pair may rise towards 1.2985.

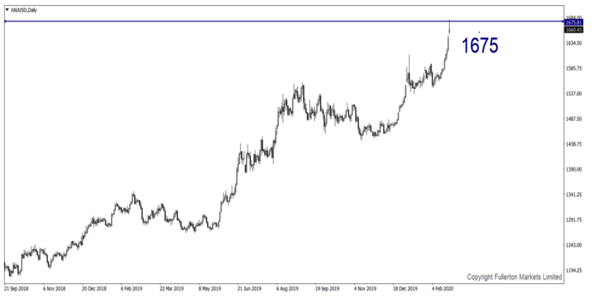

XAU/USD (Gold) – Slightly bullish

We expect price to rise towards 1675 this week.

U30USD (Dow) – Slightly bearish

Index may fall towards 28415 this week.

Fullerton Markets Research Team

Your Committed Trading Partner