Market sentiment turns fragile once again amid fears of a second virus wave, sell risk assets at this point?

Now investors are dealing with another problem: the resurgence in coronavirus cases. The US accounts for more than 25% of the just over 10 million cases worldwide, according to data from Johns Hopkins. Many experts say these figures likely understate the toll of the pandemic.

Coronavirus cases worldwide passed 10 million, with more than 500,000 deaths, resulting in the US taking steps to reverse their reopening, especially among young people. The US recorded more than 42,000 cases on Saturday, according to data compiled by Johns Hopkins University, lower than the record 45,255 recorded Friday, but the second straight daily total over 40,000.

Florida, Texas, California and Arizona have accounted for much of the recent rise in cases, prompting authorities to impose new restrictions in those states and retreat on reopening plans.

This caused pressure to be mounted on Texas Governor Greg Abbott to take additional steps to slow the spread. Dallas County Judge Clay Jenkins urged a state-wide mask order and closure of restaurants, in a letter to the governor Saturday. On Friday, Mr. Abbott ordered bars to close but allowed restaurants to remain open at 50% of capacity.

Reports are showing a surge in coronavirus cases in many places, including California, Arizona and Texas, which all broke daily records in June for the number of new infections. Stocks have given away some of the gains they racked up for the month. Heading into the second half of the year, investors and analysts are doubtful if stocks can maintain the fierce momentum of April and May.

The market appears to be safe for now, thanks to the Fed. But few believe true calm will return to the markets anytime soon. The problem that started the selloff—the pandemic—isn’t gone yet. And no one is sure when it will be either. But for now, the Fed has nearly done what it can do, market has to rely into its fundamentals at this moment.

US jobs report due this Thursday

Meanwhile, markets are looking for another employment report. The release of nonfarm payrolls data for May surprised the markets, as a gain of 2.5 million jobs was recorded following the resumption of work at factories and some service providers. A further 3 million rise is expected according to Reuters’ consensus, with the jobless rate falling further to 12.2%. The still-high unemployment rate is a reminder of how the recovery process is likely to be long and drawn out, and spending is likely to be curbed even further when additional unemployment payments end in July. Also updated are the average hourly earnings data, which are expected to show the annual rate of decline easing. Jobless claims data will meanwhile be eyed for the very latest weekly jobless trend.

Companies in the S&P 500 gave signals that outlook is bleak

More than 40% of the companies in the S&P 500 have pulled their guidance, as the coronavirus pandemic has doused U.S. corporations in uncertainty, and their shares together have fallen more than the broader index.

Through 25th June, at least 218 companies from a variety of industries have withdrawn or withheld either their quarterly or annual guidance, according to data from Dow Jones Newswires. Many cite the overall uncertainty of the pandemic for their tentativeness, but some point to the likelihood of additional outbreaks, evolving consumer habits and levers such as the need to boost pay for front-line workers.

There are still many unknown factors related to the long-term impact of Covid-19 that could influence our financial results for the remainder of 2020, investments and uncertainty related to consumer behaviours for the company’s decision earlier this month to withhold guidance.

Our Picks

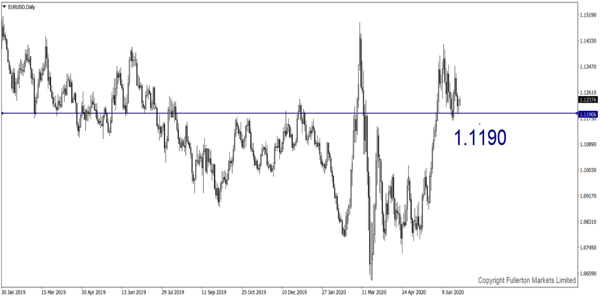

EUR/USD – Slightly bearish

This pair may drop towards 1.1190 this week.

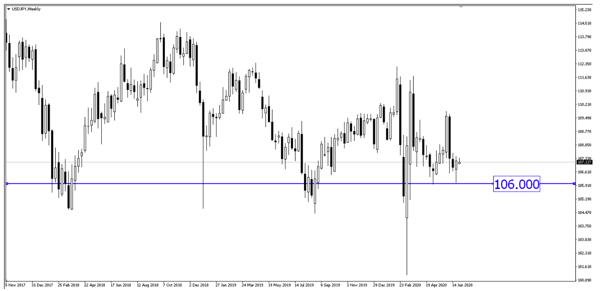

USD/JPY – Slightly bearish

This pair may fall towards 106.00.

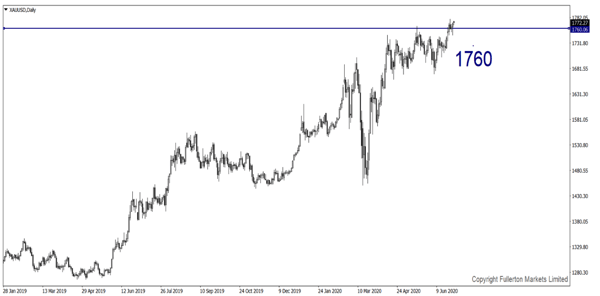

XAU/USD (Gold) – Slightly bearish.

We expect price to drop towards 1760 this week.

U30USD (Dow) – Slightly bearish

Index may drop towards 24820 this week.

Fullerton Markets Research Team

Your Committed Trading Partner