With US-China Trade tension continuing to escalate, short USD/JPY?

China said that it would impose levy tariffs on about $60b US goods as soon as the US enacts measures

The focus for the coming week will be the ongoing trade-war escalations and the impact of the recent tariff measures on producer and consumer prices.

Last week, Trump administration said it’s weighing whether to increase its proposed tariffs on $200 billion of Chinese goods from 10% to 25%. The duties could be implemented as early as next month. US Commerce Secretary Wilbur Ross signalled that there’s more pain ahead unless China changes its economic system Last Friday, China said it would levy tariffs on about $60b US goods as soon as US enacts measures; Trump’s top economic adviser Larry Kudlow said US will not back off from the trade confrontation. The escalation of the trade war would remain as a support to Japanese yen.

This week, investors will pay high attention to the US inflation gauge, looking for any possible impact from the recent trade tensions. The July measures of PPI and CPI inflation will fully incorporate recent trade policy changes, providing an early look at the degree of cost-push pressures from rising import prices due to tariffs.

If the data show that inflation pressures are less pronounced than what appeared to be the case earlier this year, the optionality around a fourth-quarter Fed rate hike will become more evenly balanced. Core inflation accelerated sharply earlier this year, but more recently, the trend appeared to have lost momentum. The three-month annualised rate of change for the core CPI was 1.7% as of June compared to 3.1% in February. We do not expect inflation to meaningfully decelerate over the medium term, but the pickup at the start of the year overstates the underlying pace.

Core CPI running at 2.3% should be consistent with the Fed’s preferred inflation gauge, the core PCE deflator which is currently holding near 2.0%. It has been at 1.9% for a while. However, until average hourly earnings growth in the jobs report reaches 3.0%, labour-cost pressures will not be entirely consistent with 2.0% core PCE inflation.

On the US jobs report side, the payroll increases in July fell significantly below the consensus forecast, but this should not be viewed as a weak jobs report. Substantial upward revisions to the prior two months pushed the cumulative gain well above consensus expectations. The unemployment rate partially reversed its July increase as labour participation remained steady. The Fed will view the July jobs report as more of the same. The pace of hiring, even at 157k per month, is above the trend and consistent with growth exceeding 2% and the unemployment rate continuing to decline. The July jobs data will have virtually no impact on the Fed’s planned September rate increase, nor will it meaningfully influence expectations for December.

Our Picks

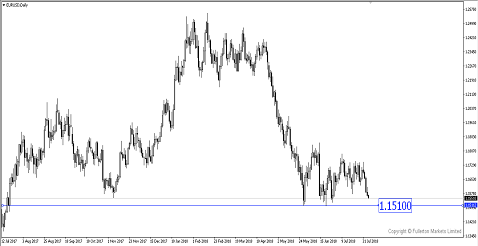

EUR/USD – Slightly Bearish.

This pair could fall towards 1.1510 this week as bearish momentum is still strong.

USD/JPY – Slightly Bearish.

We expect this pair to continue to fall to the support at 110.75 due to the acceleration of trade tensions.

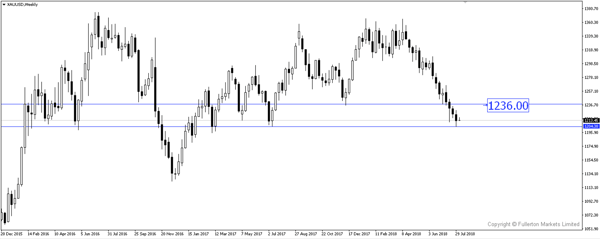

XAU/USD (Gold) – Slightly bullish.

We expect price to rebound back to 1236 price regions amidst the fear of trade tensions.

Fullerton Markets Research Team

Your Committed Trading Partner