If historical price move is a reliable gauge, short USD/JPY after Fed’s cut?

Chinese economy may have approached the bottomed in June

Fed Chairman Powell is widely expected to announce the first cut in US interest rates for more than a decade this week as he seeks an insurance policy against a weakening global outlook and rising trade tensions.

If he follows through with the move, it would be the first reduction in the federal funds rate since 2008, the aftermath of the global financial crisis. It would represent a remarkable reversal from the tightening cycle Powell pursued last year. Swap contracts imply that investors have priced in a more than 80% chance of a 25 basis point cut at the Fed’s monetary policy meeting this week, with nearly 20% likelihood of a larger cut. This came despite the fact that the US economy is experiencing its longest-running growth streak since 1854, while enjoying near-record low unemployment and record-high equity markets.

Behind the move lies four pivots in emphasis and thinking among Fed officials, each of which have contributed to the central bank’s change of direction. When Powell signalled that the Fed was pausing its tightening cycle earlier this year, the bank stressed that its posture was one of patience. Any future change in policy would be dictated by incoming data. If data turned out to be stronger than expected, Fed might return to increasing rates. On the other hand, if economic indicators weakened, it might resort to cuts.

Since then, there have been some signs of a slowdown, with second-quarter growth coming in at 2.1%, a big drop from 3.1% in the first quarter. The GDP showed substantial softness in business investment while other parts of the economy are still holding up. Consumption remains strong, as is the labour market which experienced solid employment growth in June. What has changed is that the Fed’s evaluation of the risks to the economy is weighing more heavily than it did before. As a result, it is set to act pre-emptively due to fears of the impact that trade tensions could have, rather than as a reaction to the actual fallout.

The first clear signal that Powell was entertaining a rate cut came in early June, during a low point for US trade policy. Talks with China had fallen apart, leading to a rapid and acrimonious escalation in tariffs and bilateral tensions, while US president Donald Trump had threatened to slap sweeping tariffs on Mexican products. Fed officials were never comfortable with President Trump’s trade policies, but things had looked rosier just a few weeks earlier when the US and China were on the verge of a deal. Since then, between May and June there was so much disruption on trade that Fed officials grew increasingly concerned that the uncertainty is here to stay.

Our Picks

EUR/USD – Slightly bullish

This pair can rise towards 1.1170 this week.

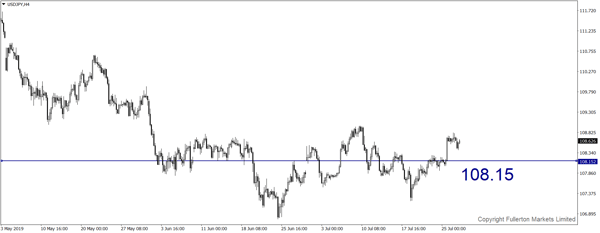

USD/JPY – Slightly bearish

This pair may drop towards 108.15 amid Fed’s rate cut.

XAU/USD (Gold) – Slightly bullish

We expect price to rise towards 1437 this week.

U30USD (Dow) – Slightly bearish

Index may fall towards 26847 this week.

Fullerton Markets Research Team

Your Committed Trading Partner