Trade tensions may continue to weigh on EM currencies, short AUD/USD?

Gains in risk assets in past days may be sustainable

Both countries are showing signs of intention to de-escalate rising trade tensions. Trump has yet to stress that he is going to further measures on China after Beijing’s latest retaliation. Meanwhile, China has announced a much smaller amount and lower tariff rates as compared to those imposed by the US. China also announced plans for a general tariff recently. This could place US business entities in China at a disadvantage when competing with other companies, and pressure Trump to cease trade war escalation.

US-China trade tensions have now lasted for six months, which simply means that there are a lot of barriers to overcome before the two countries can reach a deal at the negotiation table. Most of the talks go beyond trade issues, such as China’s market opening and governmental support of local companies.

Over the last few days, property and financial sectors have led the gains in Shanghai stocks, as there have been signs of China stepping up local fiscal stimulus and infrastructure spending earlier this month. The rise in copper price is another reliable indicator. Furthermore, Chinese importers may actively look for substitutes for their purchases, benefiting markets such as South Korea, Japan, Germany, Australia and Brazil, which export large quantities of products to China.

The slowdown of the Chinese economy looks intact toward the end of the year. US-China trade tensions are also expected to affect the regional supply chain to a certain extent as some foreign companies in China may move out of the country. Monetary easing in China is limited for now. The main constraints are the authorities’ determination to defend the yuan, and China’s deleveraging campaign showing no signs of easing.

The attention this week will be on whether policy makers will tweak their forward guidance to be less accommodative. The rate-hike path will be the main focus and we expect the tone to be less accommodative despite the US-China trade tensions.

We believe a fourth hike in December is justified based on the current US economic labour market and inflation rate. Falling dollar and rising US stocks are also supporting the Fed’s decision on a rate hike. Since trade tensions have had limited impact on the US economy, we do not expect the Fed to extensively discuss this issue.

Rising US Treasury yields remain a key negative factor pressuring EM currencies and stocks, and we do not see any visible sign that this is going to change in the coming months. Whether PBOC is to follow in Fed’s footsteps in raising rates this week is crucial; if PBOC does that, we may see regional EM currencies rise together with the yuan, as it is a clear signal that China prefers its currency to not fall too much from here. Otherwise, US/global policy divergence may continue to pressure EM currencies, including the yuan, to move lower.

Our Picks

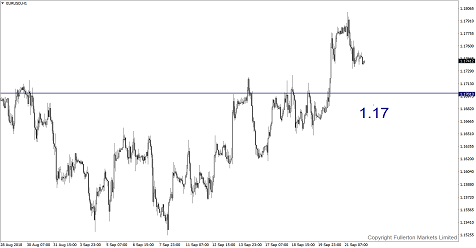

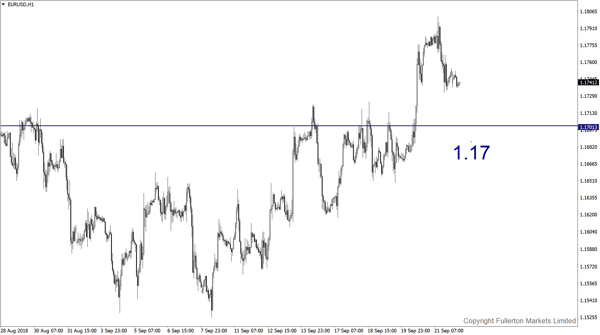

EUR/USD – Slightly Bearish.

This pair may drop towards 1.170 this week.

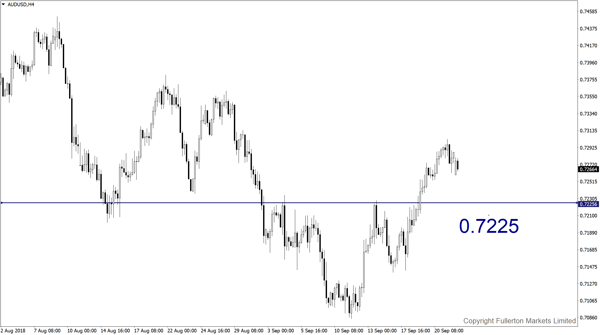

AUD/USD – Slightly Bearish.

We expect this pair to drop towards 0.7225 this week amid trade tension escalating.

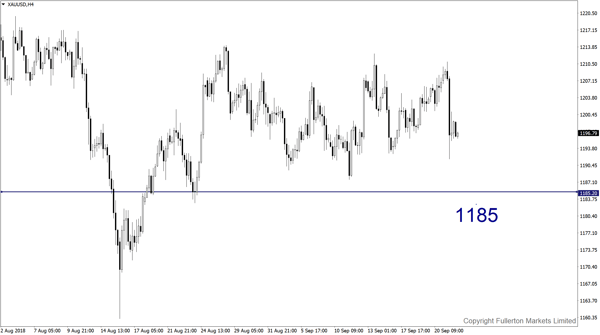

XAU/USD (Gold) – Slightly Bearish.

We expect price to fall towards 1185 this week.

Fullerton Markets Research Team

Your Committed Trading Partner