With current bets on rate cut rising amid a slowing US economy and stocks being unstable, short USD/JPY?

US 10-year bond yield is likely to approach 2% later

The world’s biggest bond market is taking away one clear message from the latest global slowdown as it shows that traders lifted the probability that the Federal Reserve will slash interest rates this year.

The yield on the benchmark 10-year Treasury note fell to 2.145% on Friday, its lowest since September 2017 after Trump said that he would slap tariffs on Mexican goods until the country prevents immigrants from entering US illegally. With heightened fears of escalating trade tensions, the impasse between China and US still looms in the background, which has sparked safe haven buying of government debt and positive-yielding US Treasuries.

Fed funds futures now imply the central bank will cut its target rate by nearly a half-percentage point by year-end, getting further ahead of policy makers who in March indicated no plans to change rates at all in 2019. Bond-market gauges of inflation expectations over the next 2-30 years are caving, with each well below the 2% mark now. Just a few months ago, these measures were on the rise as investors saw the central bank as finally having the tools to bring inflation up to target.

Until we see some hard evidence that tariffs are actually flowing through which lead to higher consumer inflation, anything to do with trade disputes around the world are going to be more of a risk-off, risk-to-global growth, and downside risk to the Fed as far as potentially cutting rates. For now, 10-year yield is likely to fall as low as 2%.

US equities also slumped as Trump opened the new front in trade tensions. Mexico is by far the largest source of US auto imports and the new tariffs would increase costs for many other major manufacturers. The Mexican peso tumbled about 2%, while the dollar jumped. The tightening of financial conditions from falling share prices and soured business sentiment is key because Fed tends to not worry about the consumer price movements stemming from tariffs. The levy increases represent a level change for prices but do not introduce a persistent inflationary impulse. That means that 12 months after a tariff introduction, the effect on inflation readings entirely disappears, so the Fed is likely to look through them.

Data released Friday by the Commerce Department reinforces the notion that inflation is not a worry for the Fed. The central bank’s favourite measure of price pressures rose just 1.5% in the year through April, well below the Fed’s 2% target. After stripping out volatile food and energy components, it climbed 1.6% – the first acceleration this year.

The slowdown in US economy, jobs growth or tariffs and these trade fights are causing businesses to retrench, then that could put the fundamentals of the real economy on a slower trajectory. So, either of those could be cause for change in the path of monetary policy.

Our Picks

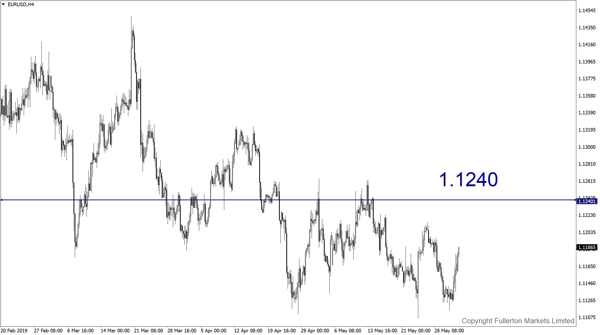

EUR/USD: The pair may rise towards 1.1240.

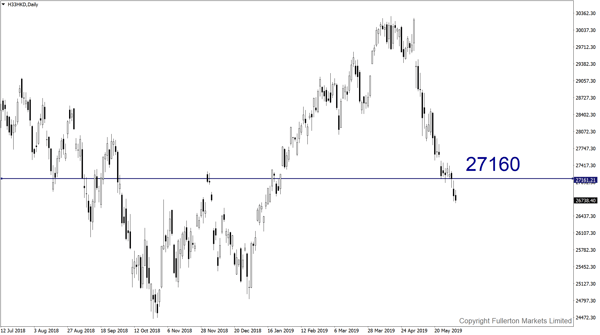

HIS/USD (Hang Seng Index): This index may drop to 27160 this week as PBOC may inject liquidity.

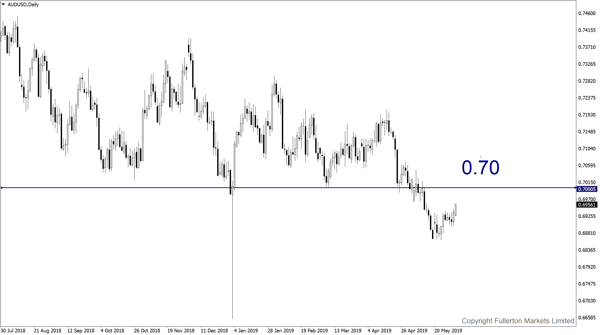

AUD/USD: This pair may rise towards 0.70 this week.

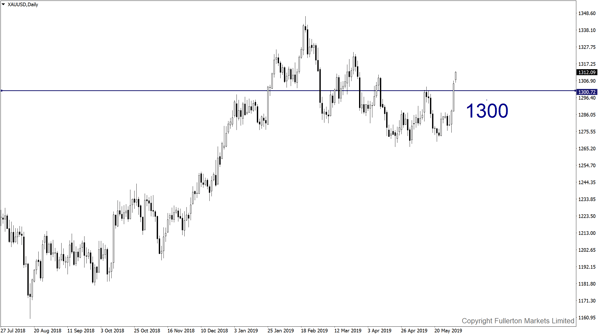

XAU/USD(Gold): This pair may fall towards 1300 this week.

Fullerton Markets Research Team

Your Committed Trading Partner