If China were to purchase more products and services from the US, short EUR/USD?

Don’t pay too much attention on Fed, inflation data is the key

The FOMC meeting will be the primary focus this week though greater attention will be devoted to economic and financial forecasts, as compared to a well-expected interest-rate increase. Aside from Fed’s meeting, the data on consumer inflation on Tuesday, retail sales on Thursday and inflation sentiment on Friday will provide insight into the underlying economic conditions that could reshape expectations for central bank’s policy later this year.

The Fed is due to hike interest rates for the seventh time of the cycle at the June meeting which is broadly anticipated by market participants. Any market reaction is more likely to be related to changed expectations for future policy and traders shall take note of this. The tone of the statement will incorporate only minor changes to the assessment of economic conditions. Traders need to focus on the inflation outlook, as well as signals hinting at how officials are balancing the trade-off between tax-cut tailwinds and tariff headwinds.

The updated summary of economic projections will probably show moderately faster growth and lower unemployment over the 2018-2019 period, and little change to the inflation or interest-rate profile in that time frame. Policy makers are cautious about overtightening interest rates ahead of a growth slowdown in 2020 as fiscal tailwinds subside. Updated interest rate projections are likely to continue to show a split between policymakers favouring three to four cumulative rate hikes this year and three more in 2019.

As we mentioned earlier, the outcome of the FOMC could be straightforward but what could complicate the market is the economic data. Retail gasoline prices rose more sharply than usual in May, which should boost the headline increase relative to the core inflation. May CPI could show both headline and core inflation trending further above 2% in year-on-year terms. While the underlying details will be carefully observed for clues indicating how the Fed’s preferred inflation gauge, the PCE deflator, will perform in the near term. However, the results will not impact policymakers’ actions at the conclusion of the June FOMC meeting the following day. Core CPI tends to run about 30 basis points above the core PCE deflator, hence the former is not at levels consistent with policymakers’ 2% objective.

Import tariffs could boost prices for some consumer goods, but it is too soon to see such an impact. It will take time to work through the supply chain, so investors should instead look for early hints of tariff-related price shocks in the producer price data on Wednesday. Producer prices are likely accelerated in May as tariffs should filter into producer prices in the coming months. While prices for steel imports have moved higher in response to the restrictions, the full tariff impact will not be realised until later this summer when supply chains have had some time to adapt.

Be prepared for any surprise from ECB

The recovery of the euro-area economy has probably advanced enough for ECB’s Mario Draghi to signal asset purchases will be ended by the end of the year. That should happen at his press conference on June 14, but the weakness of inflation will probably keep him from unveiling any concrete plans. That may have to wait until July or September.

Our Picks

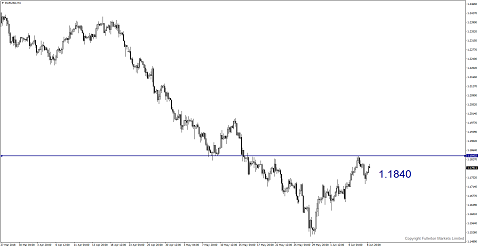

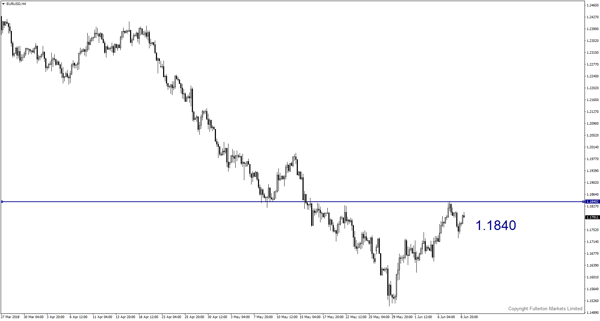

EUR/USD – Slightly bullish.

Market may underestimate the ECB’s pace on ending the bond purchasing; this pair may rise towards 1.1840 this week.

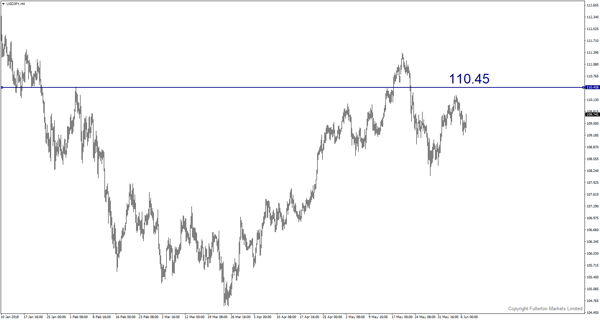

USD/JPY – Slightly bullish.

We expect this pair to rise towards 110.45 if Kim-Trump meeting in Singapore induces any risk-on in the market.

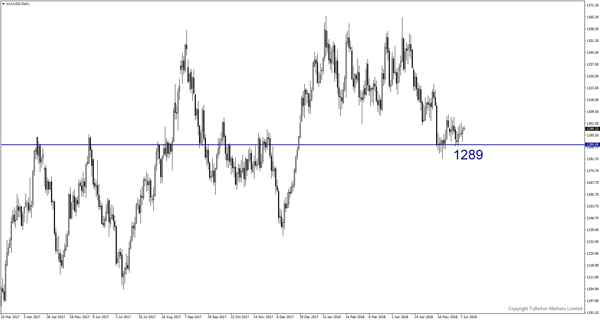

XAU/USD (Gold) – Slightly bearish.

We expect price to drop towards 1289 this week.

Fullerton Markets Research Team

Your Committed Trading Partner