With the number of coronavirus cases increasing and the slowdown in the euozone’s economy, it may be too early to call for a bottoming of EUR/USD. EUR/USD can still move lower.

- EUR/USD suffered eight days of straight losses in the last nine days which caused it to fall to a mid-2017 low.

- During its last monetary policy meeting, ECB officials defended low rates and mentioned further stimulus to support the economy.

- Eurozone data also weakened, with its industrial production falling by 3.5% while its economy grew only by 0.1% last quarter as Italy and France contracted.

- Euro being a high-beta currency did not help its case given that the coronavirus situation seems to have worsened as the weeks pass.

- US data continue to show optimism for its economy while the eurozone data seem to be weakening further. This differential will fuel EUR/USD to move lower than expected.

- Furthermore, dollar with its safe-haven status will only strengthen as the global economy slows down and the outbreak worsens .

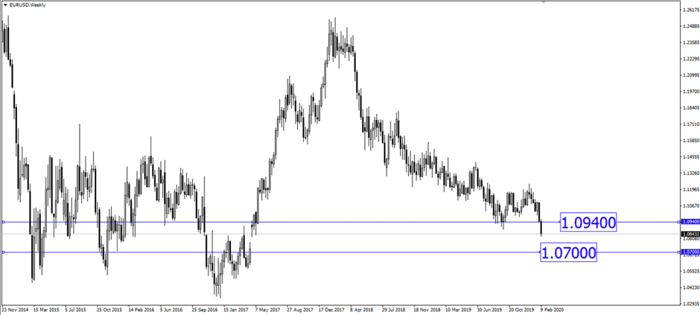

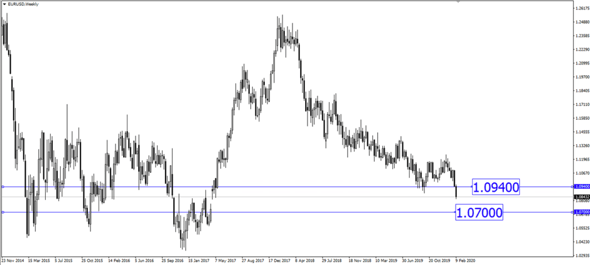

- EUR/USD after breaking its strong support at 1.0940 could head lower towards 1.0700 as long as price doesn’t retrace higher above 1.0940.

Fullerton Markets Research Team

Your Committed Trading Partner