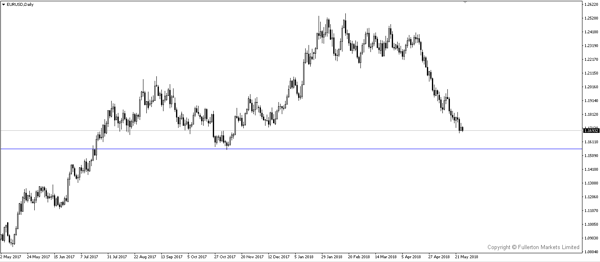

ECB may delay plans for rate hike cut of stimulus, sell EUR/USD?

During the ECB Monetary Policy Meeting Accounts yesterday, ECB mentioned that they are going to maintain a “steady hand” as they slowly reduce crisis-era stimulus given that the slowdown in growth might be worse than expected.

- ECB acknowledged that the uncertainty in the health of the economy had “clearly increased” . Though most economists view the setback as temporary, weaker sentiments surveys for the second quarter raised concerns of extended slowdown.

- The political crisis in Italy whereby increased spending was at the core of its proposal was a concern among officials in Frankfurt and Brussels.

- Last Wednesday, ECB warned that the new incoming government should continue to cut Italy’s public debt, which could hamper growth in the region.

- Market watchers are pushing back expectations of the cut in QE to later 2019 from early December this year.

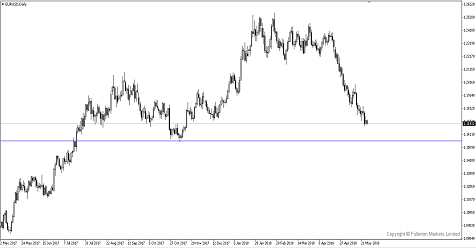

- EUR/USD could re-test 1.6000 price level if the uncertainties of the market persist.

Fullerton Markets Research Team

Your Committed Trading Partner