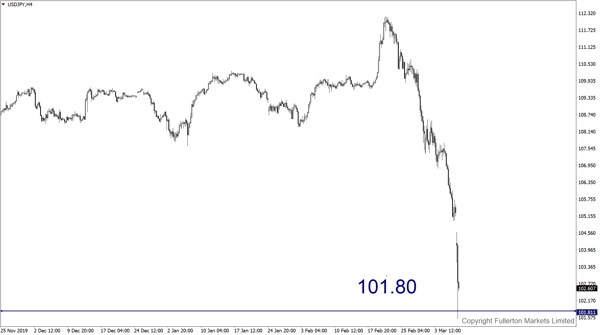

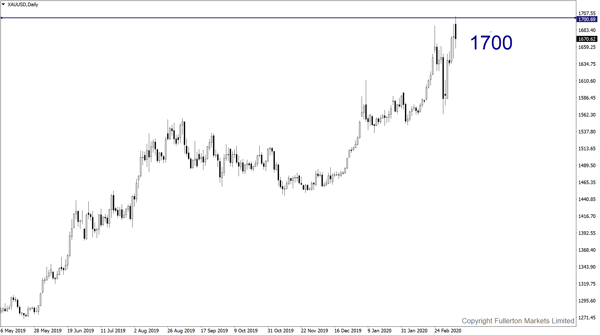

The market is in extreme risk-off mode, we recommend selling USD/JPY on peak and buying gold at dip.

Asia’s early session shows market has no confidence in economic outlook

Stock futures tumbled in overnight trading Sunday as investors continued to brace for the economic fallout from the spreading coronavirus, while a shocking all-out oil price war added to the anxiety.

Futures on the Dow Jones Industrial Average plunged 1,180 points, pointing to a more than 1,200-point loss at Monday’s open. The S&P 500 futures and Nasdaq-100 futures also indicated significant losses at Monday’s open. The sharp declines in the futures market signalled more turbulence ahead after a roller-coaster week that saw the S&P 500 swing up or down more than 2.5% for four days straight.

Overall, the dollar will weaken further this week as US yields fall and America’s domestic coronavirus outbreak expands. Sliding oil prices and related US credit stresses would not help. Not only is USD/JPY slumping Monday on haven demand, but EUR/USD is up 0.8%, while GBP/USD gains 0.3% to emphasise the dollar’s vulnerability.

This is one asset where the 2008 playbook may not apply. Many investors still cling to the dollar as a haven, with reference to the Dollar Index surging ~25% between July 2008 and March 2009. That window fails to see the entire context. The market was structurally short dollars back then, after years of dollar-selling in pursuit of diversification and yields. EUR/USD traded above 1.60 in July 2008, whereas it was at 1.08 just over two weeks ago. And that reflects the fact that recent years have seen a structural long-dollar position built up as investors again pursued yields, but this time with the combination of American exceptionalism.

Sure, the dollar will still outperform most EM currencies and even the least-liquid G10 currencies, but it’s no match for true havens such as JPY and CHF. Importantly, the very different positioning backdrop for EUR/USD will be the game-changer relative to the 2008 crisis playbook.

The contrast in healthcare systems and pandemic-response is also about to be in focus, and that could also be to the detriment of the US versus Germany, Singapore, Norway, Sweden. Germany has more than 900 confirmed cases and no deaths yet, for example, while the US has one of the lowest ratios of tracked cases to confirmed deaths.

Oil prices crashed and US equity futures plunged at the open Monday in Asia after crude producers launched a price war, an additional disruption to a global economy already struggling thanks to the coronavirus.

Among the tumultuous moves to kick off the week:

* Crude plummeted more than 30% at one point, sliding the most since the Gulf War in 1991.

* Futures on the S&P 500 Index – which face trading curbs if they move by 5% – cratered as much as 4.6%.

* Norway’s krone slid to its weakest against the dollar since the 1980s. Mexico’s peso fell as much as 6%, to the weakest as the aftermath of border-wall advocate President Donald Trump taking office.

* Australian and New Zealand 10-year government bond yields hit fresh record lows.

* Australia’s benchmark stock index plunged the most since 2008.

* The yen soared to its strongest since 2016.

Our Picks

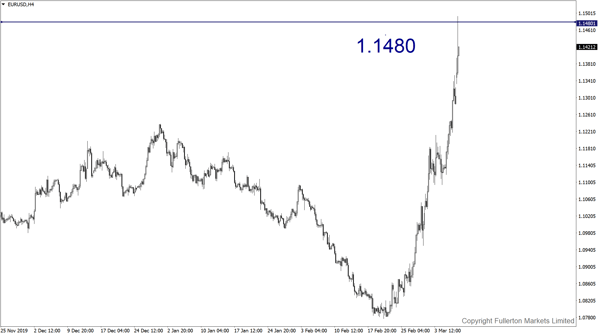

EUR/USD: Slightly bullish

The pair may rise towards 1.1480

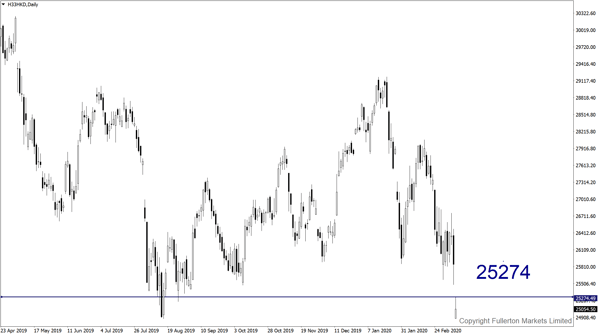

Hang Seng Index: Slightly bullish

Index may rise to 25274 this week on possible technical rebound

USD/JPY: Slightly bearish

This pair may drop towards 101.80 this week

XAU/USD: Slightly bullish

This pair may rise towards 1700 this week

Fullerton Markets Research Team

Your Committed Trading Partner