Trade tensions may continue to weigh on EM currencies, short AUD/USD?

Correlation between Aussie and EM (Emerging Markets) currencies have been staying high in the past years

Safe haven currencies held modest gains as emerging markets turn lower in risk-off mode amid concern on trade tensions. This is based on a report that the Trump administration will consider imposing tariffs on $200 billion worth of Chinese imports next week.

President Donald Trump wants to move ahead with a plan to impose tariffs on $200 billion on Chinese imports as soon as the public comment period concludes next week, according to Bloomberg News. Companies and members of the public have until 6th September to submit comments on the proposed duties, which cover everything from selfie sticks to semiconductors. The president plans to impose the tariffs once that deadline passes, according to the people familiar with the matter.

It’s possible that the president could announce the tariffs next week, but it will only take effect at a later date. Previously, the Trump administration waited for about three weeks after announcing in mid-June that it was imposing tariffs on $34 billion worth of Chinese goods before they were implemented. The next stage of tariffs is on $16 billion worth of goods in August.

$250 billion is close to half of all US imports from China and 1.8% of China’s GDP. However, the impact of tariffs would be considerably smaller due to two reasons:

Firstly, close to a third of Chinese domestic value-added exports comes from imported components. Secondly, the impact of tariffs depends on the price elasticity of demand. As the US economy is operating at close to full capacity, turning off imports and ramping domestic production would mean overheating. Higher import costs would also add to price pressure. The first $50 billion of Chinese products to be targeted are machinery and other goods which do not directly impact consumers. Pulling off the same trick with tariffs on $200 billion worth of imports would be tough to carry out. Consumer products ranging from electronics to sneakers would probably be affected.

Speculators pared their net short positions in the 10-year contract by 171k contracts from last week’s record of 701k, and cut their net short in ultra-bond futures by 12.9k contracts. This shows that the market is increasing long positions in bonds which means traders are looking for safe havens for now.

Our Picks

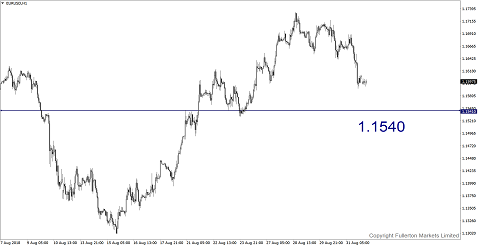

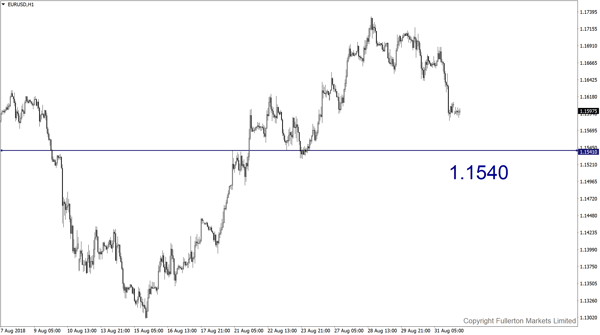

EUR/USD – Slightly bearish.

This pair may drop towards 1.1540 this week as the dollar may continue to rise.

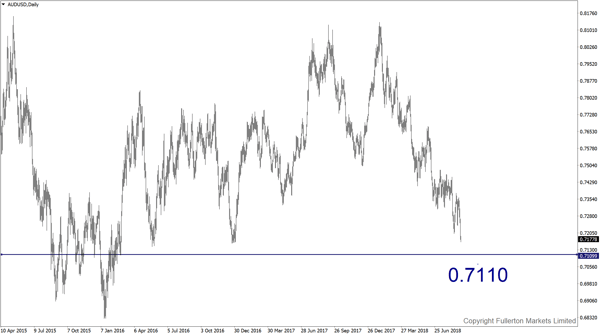

AUD/USD – Slightly bearish.

We expect this pair to drop towards 0.7110 this week amid potential escalation in trade tensions.

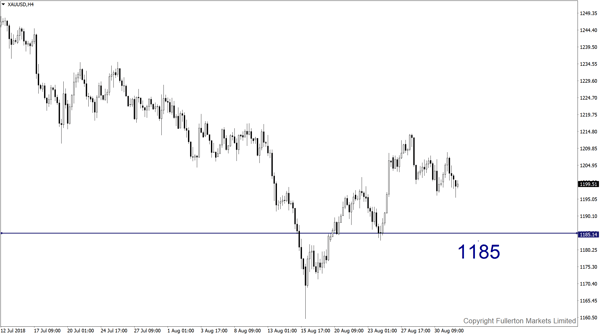

XAU/USD (Gold) – Slightly bearish.

We expect price to fall towards 1185 this week.

Fullerton Markets Research Team

Your Committed Trading Partner