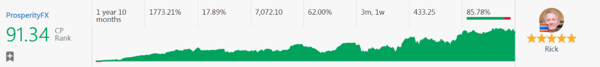

Today we look at strategy provider “ProsperityFX.” This strategy provider has been topping the chart for some time with a staggering 91.34 CP Rank!

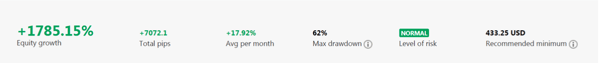

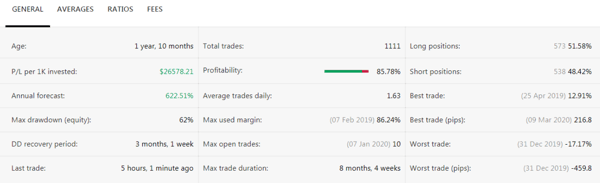

His account has been running for 1 year 10 months, with equity growth at 1785.15%. We would consider him as medium-risk trader. His Max Drawdown is 62%, yet he can generate an average per month of 17.82%.

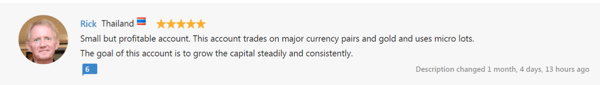

For strategy followers who are looking for a balanced result between average per month and risk, you can consider “ProsperityFX.” You can see his trading goal if you read his description, which are simple yet descriptive.

If you look at his trading statement, you will notice that he is categorised between an intra-day trader and a swing trader with pips averaging 6.37 pips per trade.

If you consider his average per month of 17% returns, you can see that he pushes his lots size to a higher quantum, given that his average pips is only at 6.37 pips.

Next, his worst trade comes in at 459.8 pips with only 17% loss, while his best trade was 216 pips with 12% profits. This means that his risk management is pretty well managed.

As mentioned above, his average pips at 6.37 pips, which means that as a Strategy Follower, you can expect similar results with his trade even if you include the 0.7 pips commission charge.

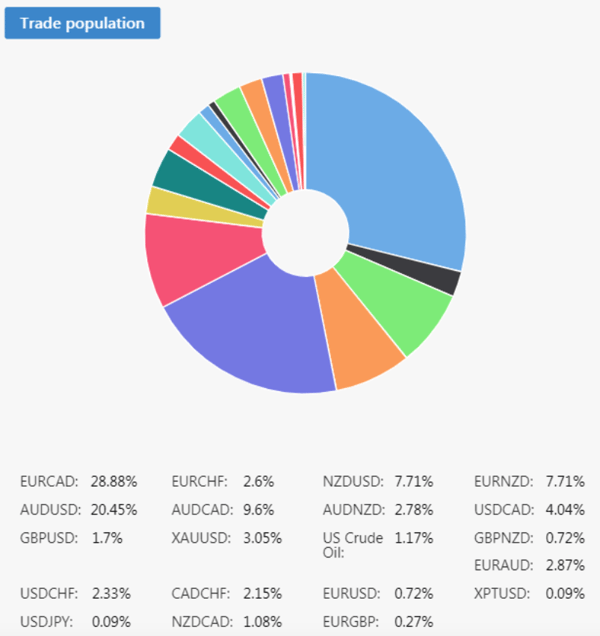

He is also a diverse trader who trades a variety of pairs and products. Lastly, my advice to strategy followers is to prepare a reasonable amount of capital and give yourself some buffer, in case he lets his losing trades float to an unprecedented level.

Fullerton Markets Research Team

Your Committed Trading Partner