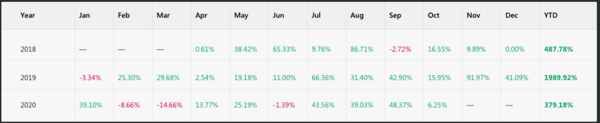

Today we look at strategy provider “ccprogress”. This strategy provider’s equity growth since inception is at 58762%. He has been running for 2 years and 5 months with his biggest loss at 14.66% in March 2020.

I would consider him as a high-returns/high-risk strategy provider. His Maximum Drawdown is at 55% which is considered low given his huge returns.

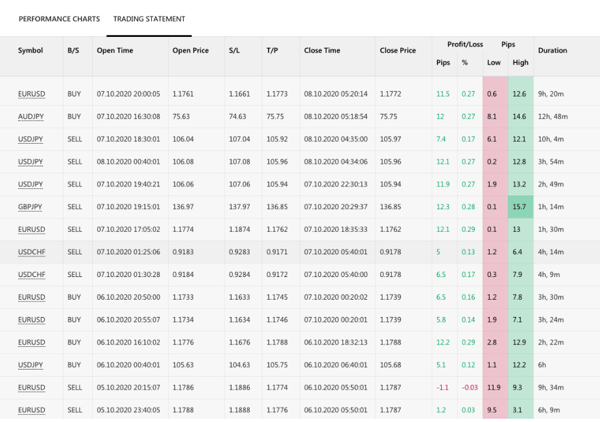

For strategy followers who are looking for a high-return strategy provider, we highly recommend you to consider “ccprogress.” If you look at his trading statement, you will notice that he is a scalper. If you’ve been following our Copy Tip of the Week, you’d know that I do not recommend following scalpers due to the 0.7pips commission charge by the CopyPip platform.

However, in this case, his average pips comes to around 9.48 and even if you include the 0.7pips commission charge, there is still a huge buffer for strategy followers to earn by copying his trades.

Lastly, as this is a high-returns/high-risk strategy provider, if you decide to follow his trades, I would advise you to prepare a comfortable capital that you are willing to lose.

Fullerton Markets Research Team

Your Committed Trading Partner