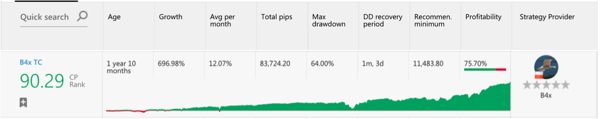

We are looking at “B4x TC” – a strategy provider (SP) whose CopyPip rank is 90.29, putting him at the 2nd place in the overall performance ranking.

At a glance, the stats showed that this provider seemed above average in terms of growth and average per month. Do note that his max drawdown could be on the high side and not a figure that most people are comfortable with.

However, just by looking at the stats is insufficient. I always recommend clients to conduct their full due diligence before following a SP. Ultimately, you are risking your own money, taking more time to learn about a SP is definitely worth the time and effort.

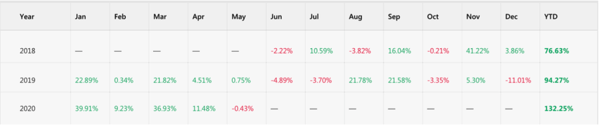

We then move on to his stats in the past 2 years from June 2018 to the end of April 2020. We can see that he was pretty consistent in profiting most months.

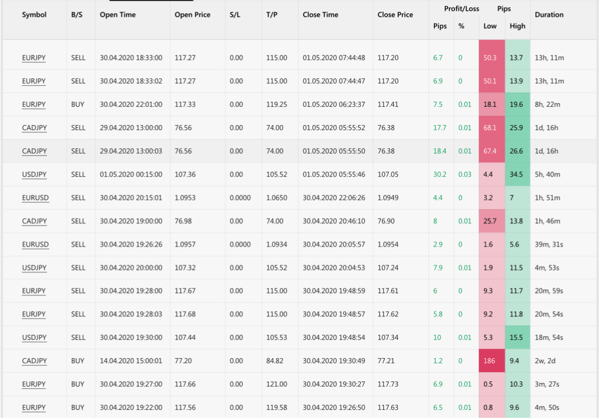

However, when I extract the trading statements of this provider, something caught my eye. We can see the amount of pips he earned per trade ranges from 1.2 pips to around 30 pips. This is on the low side because CopyPip platform charges a commission of 0.7 pip (down from 1 pip previously).

Hence, if the provider were to scalp for very little pips per trade, you are paying more commission than a trader, who is looking for more pips per trade either from intraday, swing or position trading.

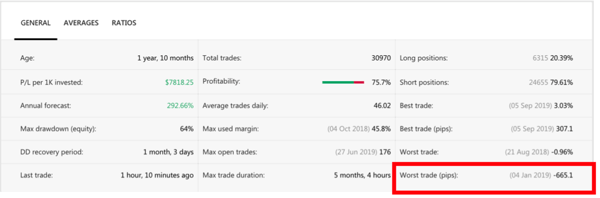

Last but not least, we look at the worst trade and it came out to be -665.1 pips. This should raise some alert or warning on your radar. If the strategy provider aims to earn 2-30 pips per trade but can afford to lose up to -665.1 pips, does the risk to reward ratio still make sense?

To be fair, his best trade came in at 307 pips which earned him 3.03% while the worst trade only lost him 0.96%. This is because the lot size used by the provider is dynamic. With the right risk management, you can lose more pips but the actual loss could be only a few percentage of your overall account equity.

Fullerton Markets Research Team

Your Committed Trading Partner