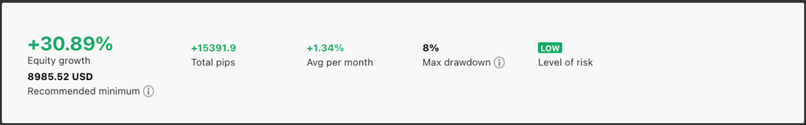

The top pick of the week is a strategy provider called “longterminvestment”. If you are looking for an extremely low-risk SP, they might just be the one.

Low max drawdown of 8% - checked✔

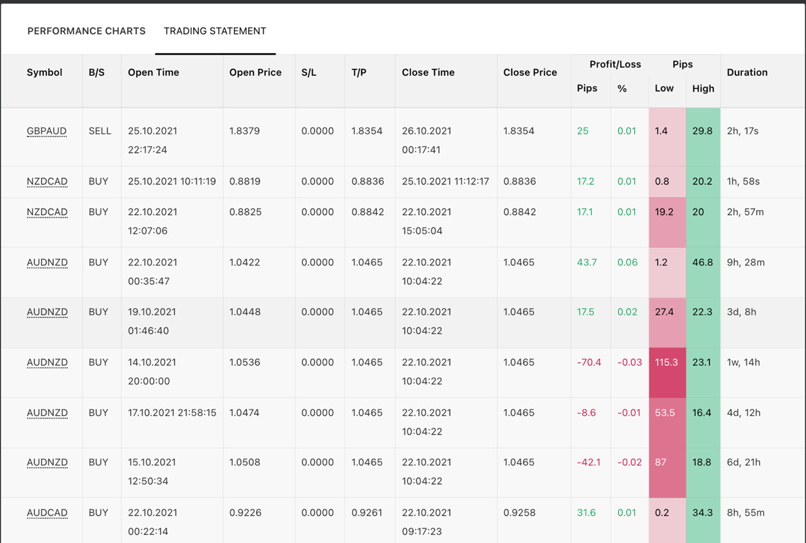

Worst trade of -647.4 pips only caused them 0.42% of loss – checked✔

Let me list down the pros and cons:

Pros

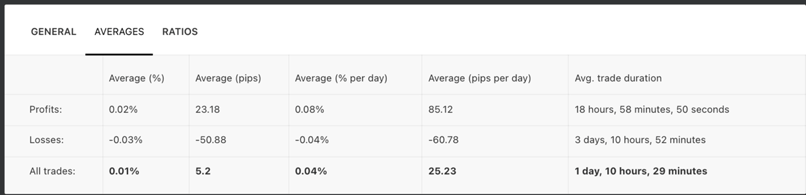

- Trades with extremely low lot size means that their risk management is on point

- Do not have a lot of trades open in short periods

- Extreme low max drawdown

Cons

- Their worst trade float to 647.4 pips, even though they only lost 0.42% of their capital

- Do not have a stop loss

We can see decent returns since they started trading in February 2020. Their YTDs for 2020 and 2021 are at 19.86% and 9.21% respectively, which is pretty impressive when we compare it to their max drawdown.

As mentioned, the max drawdown is great at 8%. We would suggest strategy followers, who want to give them a try, to add in a slight bigger capital as their recommended minimum is already at USD 8985.52.

From this trading history, we can see no stop loss was placed and some of their trades float to deep losses. Therefore, I would also recommend setting a fixed stop loss, and forced exit and stop to protect your capital.

Last but not least, their trade yields are at 23.18 pips, which are sufficient to cover the 0.7 commission that CopyPip charges.

Fullerton Markets Research Team

Your Committed Trading Partner