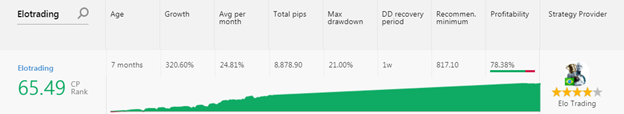

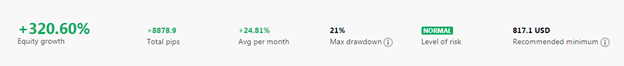

Let’s take a look at strategy provider “Elotrading.” This strategy provider’s equity growth since inception is at 320.60% with a total of more than 8,878.90 pips.

Even though their account has only been running for 7 months 3 weeks, we consider this a low-risk trader, considering their Maximum Drawdown is only 21% which is quite balanced with his average returns per month of 24.81%.

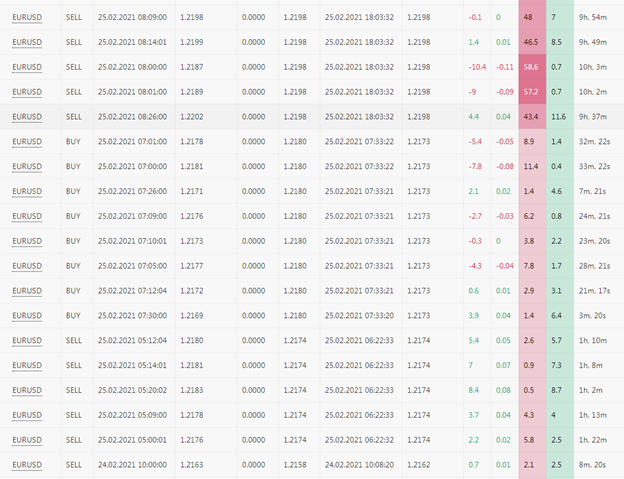

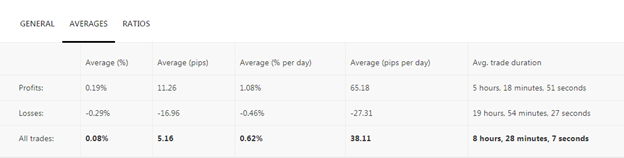

For strategy followers who are looking for a low-risk strategy provider, you can consider “Elotrading.” Looking at their trading statement, you will notice that this is a day trader with pips averaging profit of 5.16 pips.

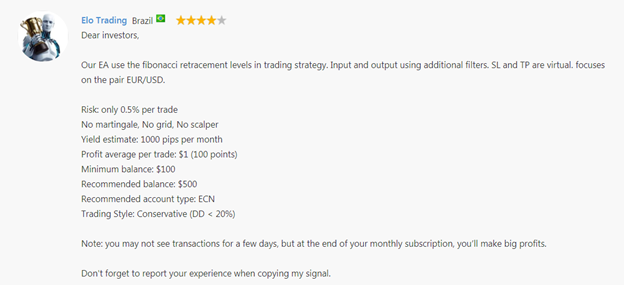

They have a very clear description of the strategy used. In the description, they also mentioned that they only trade using expert advisor (EA) and focus only on the EUR/USD currency pair, with each trade risking only 0.5% of their equity.

Their results look pretty good as they have only 1 month in red since they started on the CopyPip platform. Since March has just started, they still have time to cover back their losses this month.

As mentioned above, their average return per trade is at 5.16 pips, which means that as a Strategy Follower, the 0.7 pip CopyPip commission charges will not affect your profit that much.

Lastly, they trade only EUR/USD. As always, we advise every strategy follower to use a comfortable capital should you decide to follow this SP to give yourself some buffer in case they let their losing trades float to an unprecedented level.

Fullerton Markets Research Team

Your Committed Trading Partner