In the forex trading scene, it’s normal for new traders to start with a demo account first before switching to a Live account and investing with their hard-earned money.

There are three mains advantages of using a demo account:

- You’ll be able to trade risk-free, get access to market movements and practice your trading skills under real market conditions.

- You can experiment with different trading strategies and put them to the test.

- You’ll get enough time to familiarise yourself with the trading platform and learn how to use different trading tools and indicators to your advantage.

Similarly, on our copy trading platform, CopyPip, we offer you the option of signing up for a demo account when you first register.

These accounts last for 30 days before they expire – a reasonable period of time to be familiarised with trading. For those who wish to extend the expiration period, they can make a request via Fullerton Suite (under “Submit a request”).

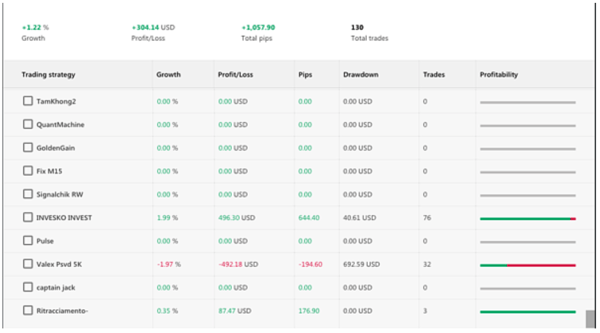

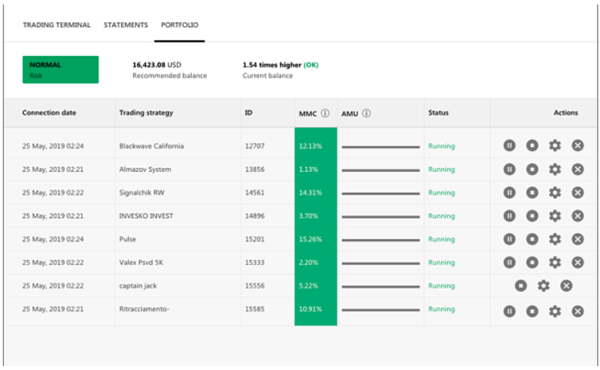

With the demo account ready, users can follow strategy providers who are within their preferred user’s risk profile (Low, Moderate or High). Depending on individual time constraints, users can follow the providers for at least one month as a rule of thumb. We can monitor all users from our Portfolio and Statements tab, as shown in the screenshots below.

Based on the results from the demo account, you’ll get a better overview on how a strategy provider is performing in real-time. This can help bridge the gap between the strategy provider’s past and future performances as real-time results are often the best record that users can refer to.

Under Statements:

Under Portfolio:

Fullerton Markets Research Team

Your Committed Trading Partner