The Copypip platform is a great platform for investors to connect, find and copy trades from experienced strategy providers (SPs). This platform provides a lot of parameters of these strategy providers for us to analyze before making our choice. It is not an easy thing to analyse and choose a suitable strategy provider when you must look at all the data. Today, we will look at 5 important factors you must know before choosing a strategy provider.

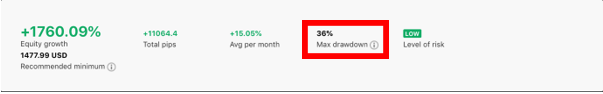

1. Max drawdown

Max drawdown is the lowest equity to capital this SP has ever encountered. A lower max drawdown means a lesser loss for a strategy provider. As a rule of thumb:

A low-risk SP should have a max drawdown of less than 40, while a medium-risk SP should have a maximum drawdown from 40-60. A maximum drawdown of higher than 60 would be a high-risk SP.

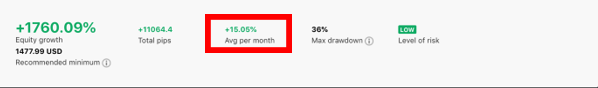

2. Average per month

This is the average monthly profit or loss of this strategy provider based on trading history. This is just an average, so don't expect too much because there will be times when profits are lower, and there will be times when profits are higher than this average.

This is the recommended minimum amount to follow this strategy provider. The recommended minimum is based on the trading lot size the SP trades. If your account is less than the recommended level, while using the automatic settings adjustment, your trade will be executed at 0.01 lot. However, in cases whereby the strategy follower’s capital is very low, even with 0.01 lot size, it could risk over-leveraging.

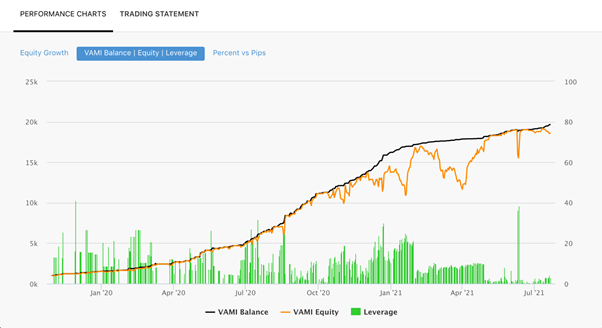

In this chart, you will see the VAMI Equity line as the orange line and the VAMI Balance line, which is the black line. When the distance between the orange line and the black line is narrow, it shows that the SP has a low negative status. When the gap between these 2 lines widens, it shows that this SP has a large negative position.

You can also observe the time when maximum drawdown of this SP occurs. The SP’s maximum drawdown might have happened a long time ago, but the SP could be trading stably currently. This is something that we should consider as well.

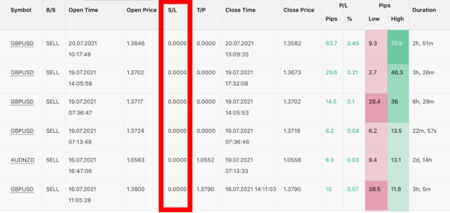

5. S/L (Trading Statement)

When following a SP, capital safety should be your top priority. One of the factors to know if a SP is safe is the stop loss level. In the Trading Statement section, you can see the history of SP's trades and pay attention to the S/L column. This S/L column will show the stop loss price of the trades. If most of the trades have S/L = 0.0000, it shows that this SP usually does not set a stop loss for its trades. So, if you want to follow this SP, set your account protection at a fixed percentage (usually by max drawdown) to protect your account in the worst case scenario.

In summary, these are the 5 important metrics you must consider before following a strategy provider. Analysing these factors will save you time and reduce your risk in finding a suitable strategy provider to follow.

Fullerton Markets Research Team

Your Committed Trading Partner