China cut banks’ RRR signals that trade tension is one of the biggest concerns for growth, short USD/JPY?

China to cut RRR(Reserve Requirement Ratios) on July 5 amid potential escalation of trade tensions

China’s PBOC will cut the amount of cash some lenders must hold as reserves, releasing a total of 700 billion yuan of liquidity to support qualified debt-to-equity swap programs and help small businesses in financing. The move is seen as a boost of confidence before a potential trade-war between US and China. However, we see the that the move may hint towards a “risk-off” environment in near future.

The required reserve ratio for some banks will drop by 50 basis points on 5 July, the country’s central bank said Sunday. That’s the day before the US and China are scheduled to impose tariffs on each other. However, China stocks extended losses even after the PBOC announced its latest RRR cut, with the US preparing to implement tariffs on 6 July.

Monday's early advance for the China Enterprise index is already reversing, and that's because the medium-term trend was set last week when the two-year bull market snapped. The 50bps RRR cut is being seen as insignificant with some investors looking for 100bps instead.

China stocks face yet another hurdle because of the growing concern that capital outflows will pick up. The yuan has tumbled to a 5-month low against the dollar and has even started weakening against the CFETS basket. The move is fuelling chatter that the government is willing to weaponize the currency as a way to maintain exports. Concurrently, the central bank is easing monetary policy which will put downward pressure on bond yields just as the Fed hikes in the US. Such a phenomenon would only add further downward pressure on the Chinese currency. The combination of a weakening currency and lower yields may lead to some investors moving money out of the country.

The PBOC's move shows how concerned officials are on President Trump’s measures and their potential to slow China’s economy. This is the third RRR reduction in 2018 . Even though PBOC has hinted a week before announcing the RRR cut the Shanghai Composite Index’s tumbled 19% from its January high shows that RRR cuts just don't have enough oomph to soothe investors.

Japanese yen climbed to a two-week high against the dollar as demand for safe haven assets rose after the US was said to be mulling further restrictions on Chinese investments, potentially escalating the trade tensions.

Our Picks

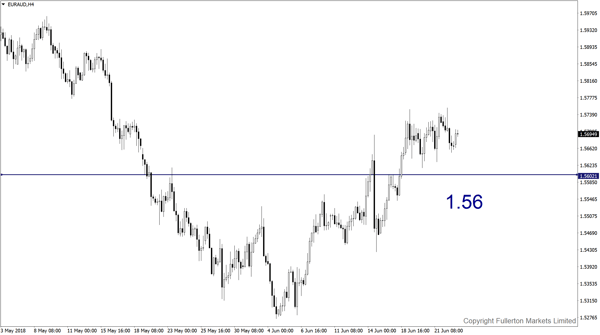

EUR/AUD – Slightly bearish.

China RRR cut may boost domestic property sectors, so Aussie may outperform Euro. This pair may drop towards 1.56 this week.

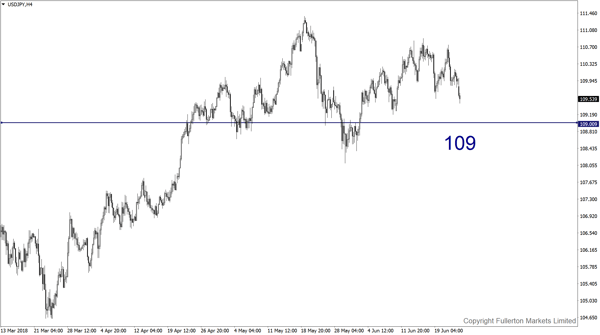

USD/JPY – Slightly bearish.

We expect this pair to fall towards 109 amid the deadline for US-China to impose tariff is near.

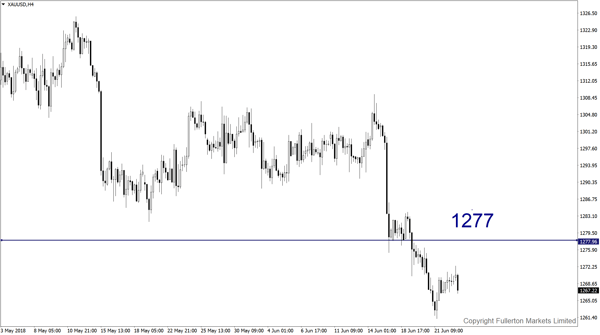

XAU/USD (Gold) – Slightly bullish

We expect price to rise towards 1277 this week.

Fullerton Markets Research Team

Your Committed Trading Partner