If China’s stocks were to hold its gains this week amid stimulus arriving, long AUD/USD?

US jobs data with Powell’s message seen to be boosting sentiment

Wall Street staged one of its biggest rallies in over seven years on Friday due to a confluence of factors, ranging from a blowout jobs report to reassuring comments from Federal Reserve Chair Jerome Powell on interest rates and signs of progress on the US-China trade dispute.

US non-farm payrolls data were a smash hit across the board. The headline number of jobs created was 312,000, beating expectations; as did wage growth and the participation rate. Even though unemployment rate edged up, it was driven primarily by previous discouraged workers entering the workforce again, and this is a positive sign. This helped soothe some of the concerns that the US economic slowdown could deepen into something worse.

Mr Powell then poured more fuel on the market rally by saying that Fed would be patient in deciding on any more interest rate increases and would not hesitate to pause its balance sheet shrinkage if necessary. At this stage of an ageing economic cycle, investors have good reasons for concern as they try to work out whether the rout in equity and credit markets represents a final correction in this cycle or the start of a lengthy decline. We have not begun a new year in such a gloomy mood since the start of 2009 and before that, 1999. Powell’s message is well seen as an assurance to investors that Fed did not forget about the recent routs in the stock market.

China cuts RRR to boost economy

China’s central bank said on Friday it was cutting the amount of cash that banks have to hold as reserves for the fifth time in a year, freeing up $116 billion for new lending as it tries to reduce the risk of a sharp economic slowdown.

The cut comes amid mounting worries about the health of the world’s second-largest economy, which is facing both slowing demand at home and punishing US tariffs on its exports. The announcement came just hours after Premier Li Keqiang said China would take further action to bolster the economy, including RRR cuts and more cuts in taxes and fees, highlighting the urgency to cope with increasing headwinds.

This speedy RRR cut with great intensity fully demonstrates the determination of policymakers to stabilise growth. The size of the cut was at the upper end of market expectations, and the net funds released would be the largest amount in the five cuts since last January.

Further cuts in the RRR had been widely expected this year, especially after a spate of weak data in recent months showed the economy was continuing to lose steam amid increased signs of a pinch from the trade war with the United States.

Our Picks

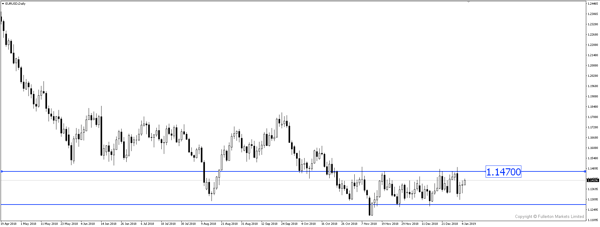

EUR/USD – Slightly bullish

This pair has been ranging for close to three months now and with dollar weakness, it could hit the resistance at 1.1470 this week.

AUD/USD – Bullish

China’s cut in its bank RRR will boost Australian dollar in the short-term and given dollar weakness, this pair could move higher to the 0.7350 price level.

![]()

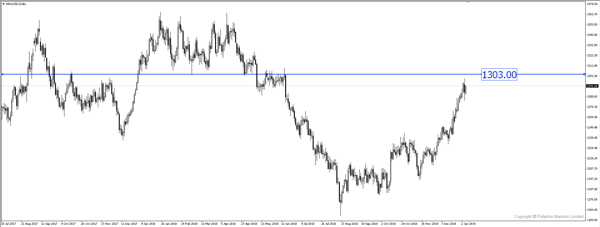

XAU/USD – Slightly bullish

This pair could continue to move higher with its strong upwards momentum to the 1303 price level.

Fullerton Markets Research Team

Your Committed Trading Partner