If all the presidents want a rate cut, shorting its currency would be ideal before its meeting; short dollar during Powell’s speech this week.

Trump wrapped up the weekend as he started jawboning Fed to lower interest rates again

US payroll shocker on Friday has placed markets at the mercy of Jerome Powell this week. But before that, don't forget another key event for this week – Powell’s testimony.

The chairman will give his semi-annual testimony to Congress on Wednesday and Thursday, potentially offering investors clues on how aggressive the regulator will be at the end of July and in the coming months. A steeper-than-expected rebound in hiring has led traders to question whether the market had been too optimistic about the extent of Fed’s dovishness. President Donald Trump wrapped up the weekend as he started jawboning the Federal Reserve to lower interest rates. This comes at a time when he may be sizing up his two latest picks for Fed governor to succeed Chairman Jerome Powell.

Before traders get answers from Powell, investors of Turkish assets will need to navigate “a new economic unknown.” President Recep Tayyip Erdogan unexpectedly dismissed central bank Governor Murat Cetinkaya, a decision that fuelled fresh concerns about the regulator’s independence just weeks before it is scheduled to decide on its policy. Erdogan’s dismissal of Cetinkaya will complicate what would have been a straightforward decision to cut interest rates on July 25. Now there’s an additional credibility constraint, with financial markets certain to scrutinise the motivation and magnitude of any easing.

The decision comes days after Turkey’s real rate soared to a world-topping 8.3% as inflation slowed more than expected, giving policy makers room to start an easing cycle. The lira’s two-month rally may unravel, with options traders the most bearish on the currency across foreign-exchange markets worldwide, according to risk reversals. The lira fell more than 3% in Asian morning trade, weakening to as much as 5.8247 from its Friday’s close of 5.628.

In Asia, China will report inflation and trade data for June this week. Exports and imports probably contracted from a year ago, which could reignite concerns over the growth outlook. Investors will be watching for signs of progress as the US and China restart trade negotiations. White House Economic Adviser Larry Kudlow said Friday that US Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin have been speaking with China’s top trade negotiator, Liu He, by phone and that more talks are planned

Our Picks

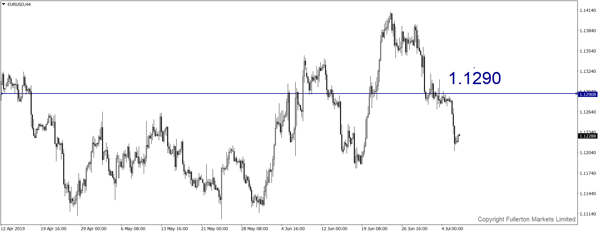

EUR/USD – Slightly bullish.

This pair will rise towards 1.1290 this week.

USD/JPY – Slightly bullish.

This pair may rise towards 108.80 as risk sentiment could improve.

XAU/USD (Gold) – Slightly bullish.

We expect price to rise towards 1415 this week.

U30USD (Dow) – Slightly bullish.

Index may rise towards 26920 this week.

Fullerton Markets Research Team

Your Committed Trading Partner