With almost all Fed officials looking to end the balance sheet runoff and uncertainties on more rate hikes, Long EUR/USD?

The Fed meeting minutes that were released did little to alter views on the central bank’s policy path which was to pause rate hikes until either inflation rises higher than the baseline forecast, or the economy improves. What is certain is that almost all Fed officials wanted to end the balance sheet runoff later this year.

The surprisingly dovish decision came amid mounting risks to the US economy, including slowing Chinese and European economies and waning stimulus from the 2018 US tax cuts.

The investors have gotten nervous that the Fed would allow the reduction to continue even if financial conditions tightened. The statement from the minutes echoes recent comments from several Fed officials that the program will likely end before the year concludes as bank reserves fall to a level with which regulators and financial institutions feel comfortable.

However, Fed did leave itself some room for rate hikes if needed as the Federal Open Market Committee members noted that if the potential headwinds eased, a re-evaluation of the "patient" approach would be warranted.

Euro PMIs released today show that the economy seems to be accelerating with most of its data surpassing forecast. This could be a sign that the eurozone is improving despite the global economy’s slowdown.

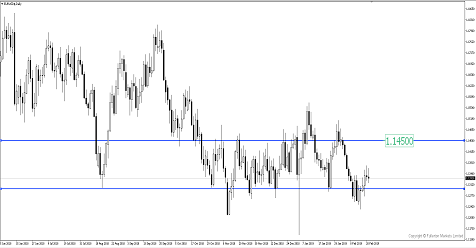

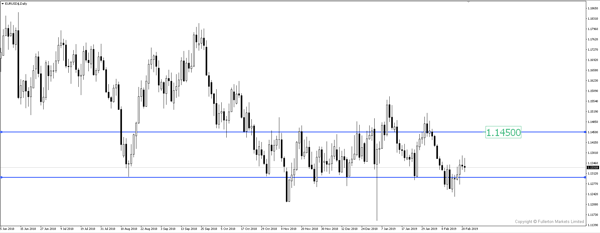

EUR/USD has been consolidating between the 1.1320 and 1.1360 price level for the day. The 1.1370 resistance seems to be hard to break but once broken we could see EUR/USD rise towards the next resistance at the 1.1450.

Fullerton Markets Research Team

Your Committed Trading Partner