BOJ’s unlimited fixed-rate bond-purchase might be a mistake, sell USD/JPY at peak?

Instead of talking up the economy like what most of the major central banks do, BOJ is engaged in a concerted effort to express its concern on higher rates and yen. Clearly, it’s not a wise policy move as recent higher rates and yen reflected global synchronised recovery instead of a risk-off move in crisis period.

- BOJ offered to buy 5-to-10 year notes at a fixed rate of 0.11%, and also expanded debt purchases at its regular operation for the second time in a week.

- This is the first unlimited fixed-rate bond-purchase operation since July last year, seeking to assert control over the nation’s yields.

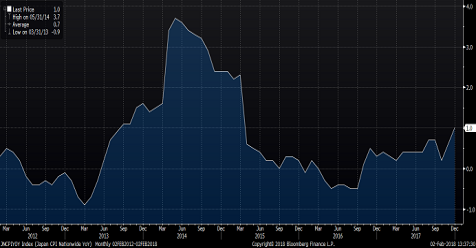

- Over past months, many investors are starting to expect the Bank of Japan to lay groundwork for tapering its stimulus sometime this year. However, the BOJ seemed to be telling everyone that their policy is not going to change anytime soon. This is not a consistent move for BOJ as Japan’s inflation has bottomed since late 2016.

Japan CPI YoY

Fullerton Markets Research Team

Your Committed Trading Partner