The US decided to increase its tax rate from 10% to 25%.

- This move will affect Chinese products.

- Commodities currency such as Australian dollar and New Zealand dollar could take a hit amidst the uncertainty. Both central banks remained dovish as RBNZ cut rates while RBA has slashed economic growth rate.

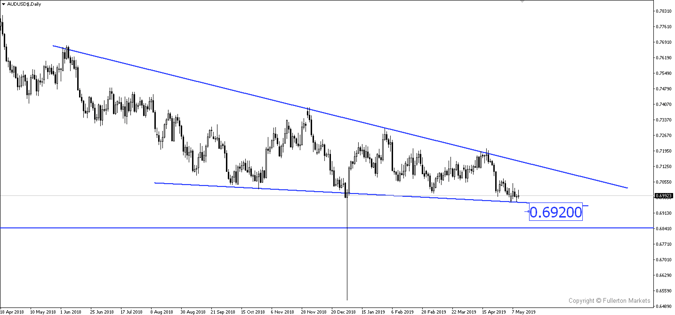

AUD/USD could be heavily impacted by the trade negotiations and monetary policy changes in time to come. With RBA slashing growth forecast, market is pricing in a 25% rate cut in June, perhaps having burnt their May bets. The odds will increase nearer to date and a rate cut seems inevitable.

AUD/USD could fall towards the 0.6920 which is a Feb 2016 low when market starts to price in a rate cut by RBA.

Fullerton Markets Research Team

Your Committed Trading Partner