With unemployment rate still high and Q2 CPI expected to remain the same, Short AUD/USD?

Australia’s job data released yesterday showed 50.9k new jobs were added in June, surpassing the forecast of 17k. Out of those 50.9k, 41.2k were full-time positions. This was the largest increment since November 2017 which is a sign that the Australia’s economy is improving.

Unemployment rate, on the other hand, held steady at 5.4 percent. This could be due to participation rate increasing to 65.7 percent, from 65.5 percent in May. Nonetheless, the labour supply is still expanding to meet demand and we would not be seeing pressure on wages and inflation in the near term.

Though the jobs data is undeniably strong, we might not see any near-term growth in wages and eventually inflation. This could weigh on RBA’s decision to increase rates anytime soon. Furthermore, jobs data is only 1 out of the many factors that RBA will consider before lifting official cash rate.

Market will be looking out for Q2 CPI next week and Q2 Wage Cost Index on 15 August to see if the growth in the economy is in line with what the jobs data show.

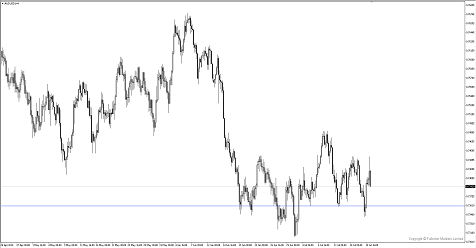

AUD/USD gains after the stronger jobs data fizzled as investors could not see a meaningful pressure on wages. Moreover, the weakening of yuan which fell to one-year low versus the dollar could mean a slowdown in Australia’s exports as well. We could see more downside for AUD/USD this week.

Fullerton Markets Research Team

Your Committed Trading Partner