With the latest report announcing that the EU and Britain have finally removed the biggest roadblock to their Brexit divorce deal, this could improve the chances of the withdrawal agreement being accepted. Long GBP/JPY?

This week is important for Brexit as there will be votes on Tuesday, Wednesday and likely Thursday. Three things will be determined over these three days:

- Whether UK will accept or reject the withdrawal agreement

- Will UK leave without a deal?

- Will UK invoke Article 50 to extend the Brexit deadline

On Tuesday after the debates, UK’s MPC will be voting to accept or reject the withdrawal agreement presented by Prime Minister May. May said new documents are to be added to the deal provided “legally binding changes” to the part relating to the Irish border. However, the legal 585-page withdrawal agreement itself was left intact. With the last-minute Brexit changes ahead of the crucial vote today, this could increase the chances of members accepting the deal.

If accepted, we would see Sterling pairs spike up higher within minutes before investors realise that there will be more issues heading the UK’s way in terms of trade agreements.

If rejected, which is highly possible as well based on reports that May’s Cabinet has rejected the EU’s latest backstop terms before the last-minute changes, May will then hold a vote on Wednesday to decide whether the UK leaves the EU without a deal. That would be the worst outcome which could send Sterling down 2-4% in a matter of minutes.

And if the members reject the no-deal proposal, Parliament will vote on Thursday on whether to invoke Article 50 to extend the Brexit deadline.

There is one last possibility for Brexit votes this week which is the withdrawal agreement being rejected by a small margin. May has the choice to try for another vote after March 22 during the EU summit. This could lead to the technical no-deal exit that the EU previously mentioned but regardless of whether it is technical or real, sterling traders will not interpret a further delay in the final decision as positive for the currency.

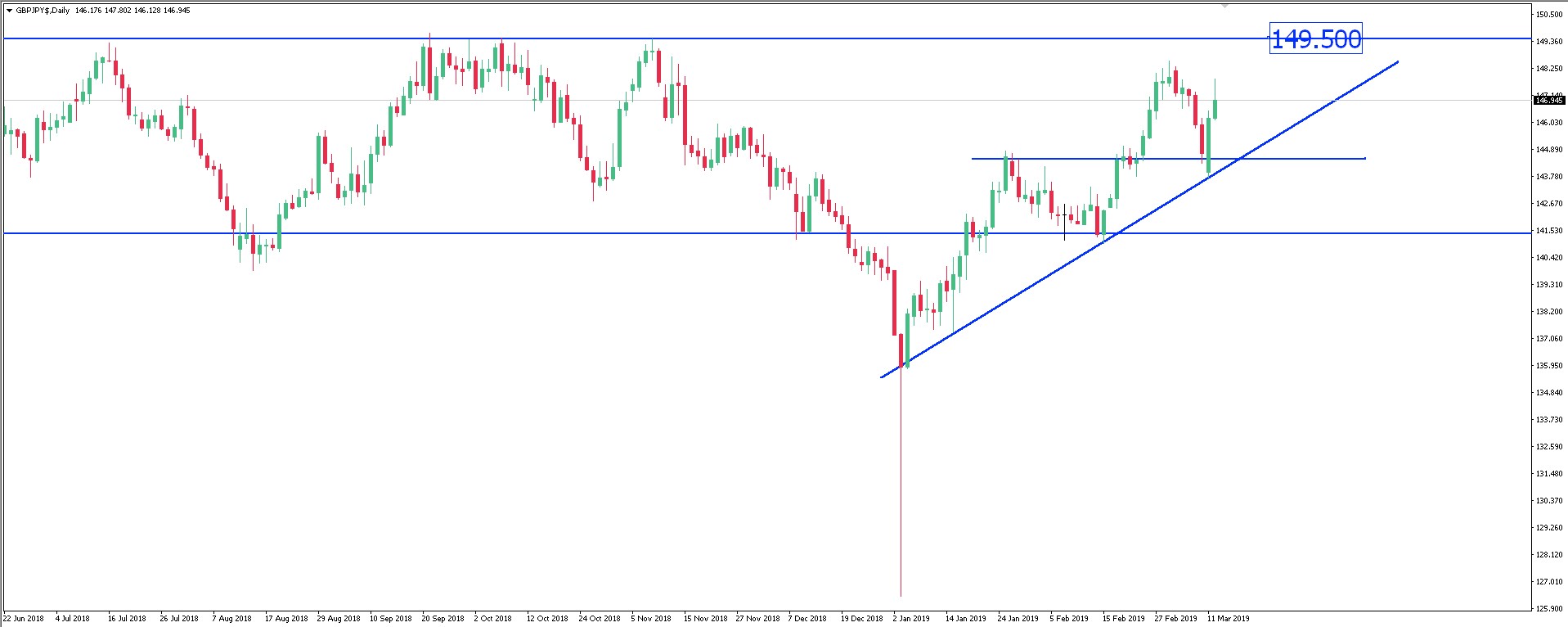

GBP/JPY rose by 400 pips last night after the report that last-minute changes were made to the withdrawal agreement. If the last-minutes changes lead to the agreement being accepted, GBP/JPY could rise and touch the six-month resistance of 149.50.

Fullerton Markets Research Team

Your Committed Trading Partner