With the bushfires and coronavirus continuing to weigh on Australia’s domestic growth, RBA may be forced to cut rates next month. Short AUD/JPY?

- RBA Governor Lowe kept rates unchanged at 0.75% for the first meeting of 2020 as widely expected.

- The main reason for the neutral stance was due to Australia’s stronger labour data and property market.

- Australia is suffering from a slowing Chinese economy, as a result of the travel ban and reduction in domestic demand due to the coronavirus outbreak. This is especially aggravating given that China is Australia’s biggest trading partner.

- Governor Lowe said: “With interest rates having already been reduced to a very low level and recognizing the long and variable lags in the transmission of monetary policy, the board decided to hold the cash rate steady.”

- The odds of a rate cut might start to increase as the coronavirus epidemic continues to worsen.

- Governor Lowe will be speaking at the National Press Club on Wednesday, followed by three hours of parliamentary testimony on Friday, when RBA’s updated quarterly forecasts will be released.

- We believe that RBA may be forced to cut rates further if the situation worsens.

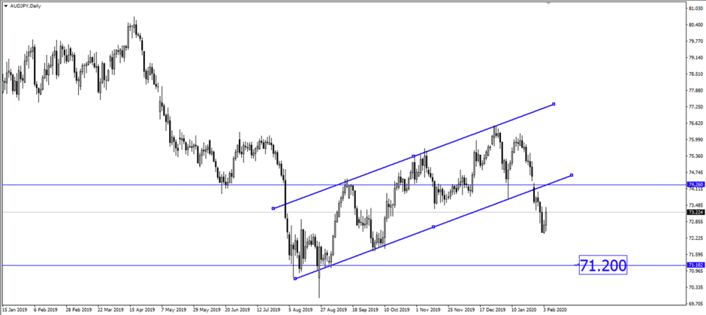

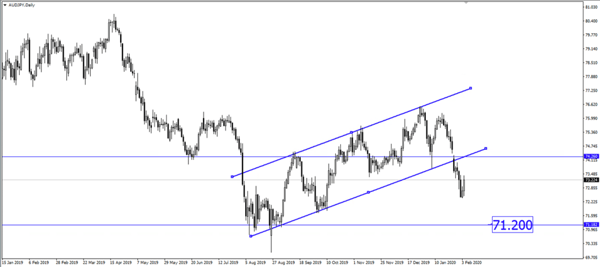

- AUD/JPY could slide lower towards 71.20 after price broke the channel support, and is looking to retest the broken support turn resistance.

Fullerton Markets Research Team

Your Committed Trading Partner