With Powell expected to approve 2 more rate hikes this year, Long USDCAD?

During Fed Chairman Powell’s testimony, he has made it clear that the central bank will continue to raise interest rate at a pace of every 3 months. This was backed by a strong job market and inflation running around Fed’s 2 percent target for the first time.

Powell noted that Fed is seeing the risk of the economy unexpectedly weakening as roughly balanced with the possibility of the economy growing faster than they currently anticipate. He also mentioned that “Robust job gains, rising after-tax incomes, and optimism among households have lifted consumer spending in recent months. Investment by businesses has continued to grow at a healthy rate."

When asked on the ongoing trade war between US and its global competitor, Powell only briefly mentioned that it is “difficult to predict” what the implications could be. Lastly, when asked about the flatness of the yield curve, Powell said he used the measure as a signal for where policy rates are relative to their neutral setting. This means that Fed officials are very much concerned about the inverting yield curve and will be monitoring it closely.

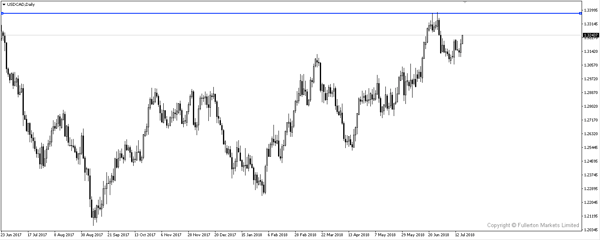

After the hawkish announcement yesterday, USD/CAD rose by 100 pips breaking the 1.3200 price barrier. We could see this pair continue its momentum to hit last month high of 1.3380 before hitting a major resistance.

Tonight, Powell will appear before a House committee for his second testimony and we are not expecting him to deviate too far off from his hawkish stance.

Fullerton Markets Research Team

Your Committed Trading Partner