Odds of a no-deal Brexit increased after PM Johnson said he will not meet EU leaders unless they shift their Brexit position. With GBP/USD hitting a 2016 low, we could expect some retracement after Fed cuts rates this week.

New UK PM Boris Johnson issued an ultimatum to the EU stating that he will not start talks with the EU unless they are willing to revise the deal that has been rejected three times by parliament. Market increased bets that PM Johnson will likely leave the EU with no agreement, which has led GBP/USD to fall to a 2016 low.

PM Johnson has two key conditions for a deal to be made:

- Reopen the Withdrawal Agreement the EU negotiated with previous PM Theresa May.

- Scrap the so-called backstop guarantee for the Irish border – the provision intended to ensure there’s no need for checks on goods crossing the land border with Ireland.

With less than 100 days left before the UK is due to exit the bloc on 31 October, it seems like the UK may be prepared to leave without a deal. This is further supported by the EU showing no signs of shifting its position.

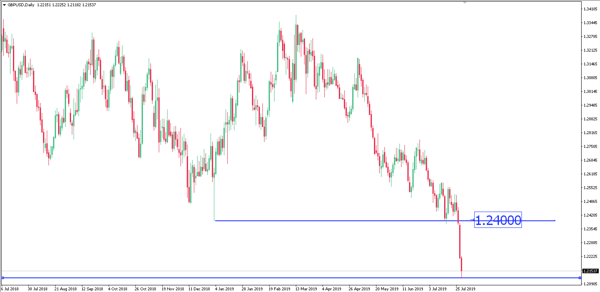

We may expect further fall in sterling as the deadline nears. However, GBP/USD could rebound with Fed cutting interest rates this week. This could create a potential divergence in monetary policy between the US and UK. Bank of England is expected to keep rates unchanged which could further the cause of a divergence.

GBP/USD could rise to 1.2400 as FOMC looms near.

Fullerton Markets Research Team

Your Committed Trading Partner