Report crossed wire that ECB members are expecting a rate hike at the end of 2019, Long EURUSD?

Euro versus the G7 major currencies spike up on news that some ECB members fret over late-2019 rate hike bets. In June’s ECB meeting, ECB President Draghi mentioned it will end net bond purchases this year, but also that interest rates will stay unchanged until “at least through the summer of 2019.”

- Investors have raised the chances of a September rate hike from less than 70 percent to 80 percent after the ECB rate hike reports was disclosed.

- German factory orders surged in May as they rose for the first time this year, and a measure of private-sector activity in the euro zone increased in June. This led us to believe to euro-zone weakness is temporary.

- German front-end government bond yields rose as well after today’s update crossed the wires which indicates market are more bullish towards ECB’s monetary policy expectations.

- ECB Executive Board Member Yves Mersch commentary could shed some light on whether he is in favour of tightening sooner as well.

- After announcing the wind-down of bond purchases , the new guidance on rates will be ECB’s main tool in the future. The timing of the rate hike will largely depend on the incoming data for the next few months.

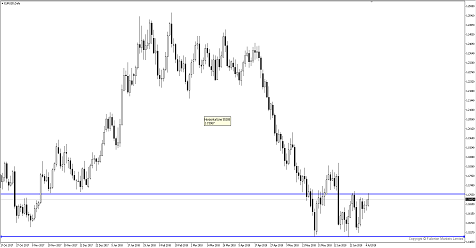

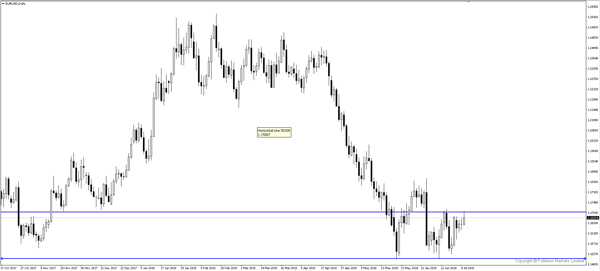

- EUR/USD is currently consolidating as price failed to break the 1.1700 price region for close to a week. We could see more upside as long as the support 1.1500 holds.

Fullerton Markets Research Team

Your Committed Trading Partner