As Draghi said that risks had now “moved to the downside,” this could mean that the rate hike in 2019 could be delayed to 2020. Short EUR/GBP?

The ECB left interest rates unchanged last night which was widely expected as President Draghi said last year that interest rates are only expected to rise in the summer of 2019. However, the interest rate hike could be further delayed after Draghi said that growth risks in the region had shifted to the downside due to a number of external factors. This was a sharp difference from its assessment just six weeks ago that risks were “broadly balanced”.

One of the factors is the turmoil in the eurozone. The slowdown in growth in Germany, France and Italy in the fourth quarter of 2018 has prompted fears of recession among investors. Germany’s growth slowed from 2.2% in 2017 to 1.5% in 2018, the slowest growth rate in five years. Similarly, the ongoing “Yellow Vest” protest in France is crippling its economy as the country is faced with 10 consecutive weeks of unrest. Lastly, Italy’s growing concerns over its key budget deficit target have led analysts to predict further tightening measures by the government.

Other factors include Brexit, slowing Chinese growth and the fallout from the US-led global trade tensions.

The ECB has hinted that it might have to keep its monetary policies loose enough to help the region’s economy out of a new slump. This is less than a month after stopping its Quantitative Easing (QE) programme that helped rescue the eurozone from a recession in 2015. The ECB also kept its plans to reinvest cash from maturing bonds for an extended period of time beyond its next interest rate hike. These purchases are designed to keep borrowing costs down through to sometime in 2021.

All in all, it seems like the ECB’s strategy of gradually normalising will be on hold for as long as uncertainties mentioned by President Draghi weigh over the eurozone. The euro could be pressured lower with no interest rates in sight.

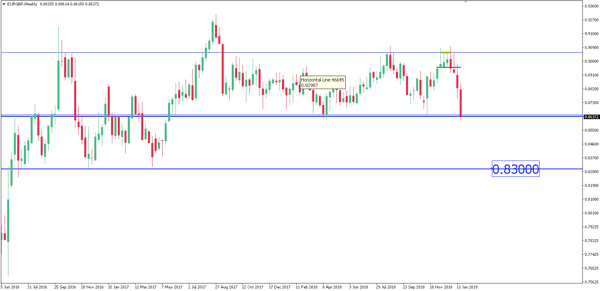

EUR/GBP has fallen over 300 pips since last week and is currently sitting on a weekly support on the 0.8620 price level. This pair could fall towards the 0.8300 level once the support is broken.

Fullerton Markets Research Team

Your Committed Trading Partner