With Fed being one of the few central banks that aren’t hinting at a rate cut, this could create a monetary divergence between Fed and the rest of the central banks. EUR/USD could fall lower.

Fed left its interest rate unchanged during its monetary policy as widely expected at a target range of 2.25% to 2.5%, noting that inflation is “running below” its stated target of 2%.

Dollar rallied after Fed Chairman Jerome Powell dismissed any hint of easing, opposed to his peers who are looking at possible rate cuts in the near term.

- Powell said the current policy stance is “appropriate right now” and “we don't see a strong case for moving in either direction.” With nearly every central bank looking for a rate cut, Fed’s move is seen as hawkish.

- Powell also acknowledged the softer data from inflation, weaker consumer spending and business investment.

- However, he downplayed these concerns saying that low inflation is due to transitory factors and consumer spending and business investment should pick up with risks such as Brexit, the US-China trade war and European tariffs having “moderated.”

There are two reasons why we feel that the dollar could continue to strengthen:

- Powell is optimistic on the recovery of the economy and that view has been justified with the improvement of job growth, retail sales, manufacturing activity and GDP.

- The divergence of monetary and economic policy between the US and the rest of the central banks.

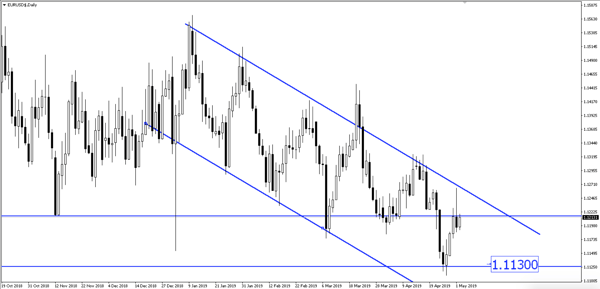

With this in mind, we believe that EUR/USD will worst hit as this pair has broken the historical support at the 1.1150 price region and could head lower towards 1.1130 again.

Fullerton Markets Research Team

Your Committed Trading Partner