China may buy less iron ore from Australia after solid growth data, long EUR/AUD?

China’s economy has the first full-year acceleration growth since 2010, giving authorities more room to purge excessive borrowing and deleveraging which is set as the top priority in 2018.

- 4Q GDP increased 6.8% y/y, compared to a 6.7% in earlier estimates.This makes its full-year growth picked up to 6.9 % from 6.7% in 2016

- Chinese authorities have less desire to accelerate its infrastructure spending in 2018 amid growth stabilization, thus commodity imports from Australia may decrease

- AUD/USD gained as much as 0.2% earlier with little change currently

- Better-than-expected GDP data also reduces the needs for the PBOC to weaken yuan, which also provides the support to the regional currencies, leading to a weaker dollar. Hence, Aussie weakness could partly be offset by the weakening in dollar

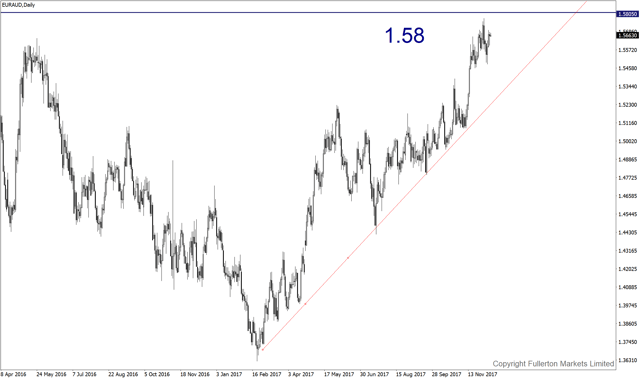

- Amid such a backdrop, we estimate the EUR/AUD to continue to trend higher

Fullerton Markets Research Team

Your Committed Trading Partner