In order for us to make a better trading plan, we need to always know the current market news. Here is the 5 market news for 2018, that you have to know.

1. US Dollar- Treasuries’ yield curve holds the key to the FX moves

Dollar index dropped around 10% last year while the Fed raised the interest rates by three times in this period and the US economy remained resilient. None of the major central bank was able to catch up with the pace rate hike. However, the greenback still under-performed against all G-10 currencies across the board.

Euro strength contributed to the dollar weakness without doubt, but the flattening yield curve in US Treasuries was the main driver for a lower dollar index. If you can recall after better-than-expected US economic data released last year, most of the time dollar fell. You can say they are reactions of “profit-taking”, but that seemed like a weak argument. If profit-taking was the reason behind the dollar weakness, you could just sell the dollar after any US data regardless of a strong or poor data.

Though curve flattening isn’t really a signal of upcoming recession, it reflects the pessimism on the nation’s long-term growth and inflation outlook. More importantly, it restricts the policy room or even leads to a policy dilemma. Assuming the Fed were to raise the policy rate by another 5 times, the 2-year US Treasury yield may exceed 3%, higher than the current 10-year sovereign rates which is an invert curve.

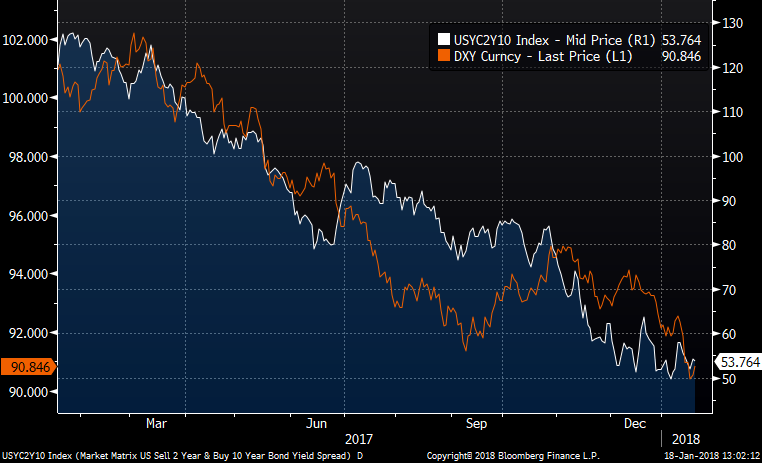

In our opinion, short-end rates are more sensitive to the long-end rates causing the curve flattening upon those strong economic data released. Thereby artificially lowering the long-term inflation expectation. Historically, the dollar has been moving in tandem with the spread between 2/10 Treasuries yield. In past 12 months, the correction reaches 0.84. This may explain why the dollar’s moves last year seemed not justified to its economic condition and Fed’s monetary policy.

White line: US 2/10 yield spread; Orange line: dollar index

The USD Market Matrix, Source: Bloomberg

At the current backdrop of Fed’s continuous tightening and the next hike could be happening in March, short-end rates is expected to rise further. Under such assumption, acceleration in its inflation growth is one of the few drivers to lift the long-end rates. Tax reform’s impact on consumption is unknown for now, and the Fed hasn’t adjusted the policy on that.

Recent US jobs data is also seen as negative to the greenback. Falling unemployment rates intensifies the expectation of rate hikes while tepid wage growth deteriorates the expectation on the inflation. Therefore, the US curve is difficult to steepen amid such economic development. In other words, possibility of rebound in dollar looks low at this moment fundamentally, unless new Fed chief Powell tweaks Yellen’s existing forward guidance.

2. China – Stable yuan and economic policy may have also cause a soft greenback

Chinese’s influence on global FX markets was mainly limited to Aussie and Kiwi dollar five years ago, but it is different now. Yuan policy and current economic condition in China also partly resulted in the dollar weakening.

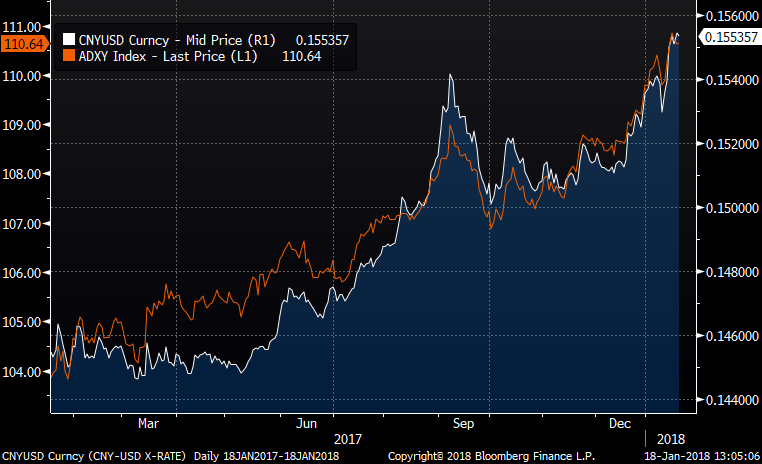

After PBOC reformed its yuan fixing regime on August 2015, a more market-based yuan’s influence on regional FX largely increased. There is a correction between yuan and Asian currencies index at 0.83 for past 2 years.

White: CNY/USD; Orange: Asian currency index

The CNY/USD Matrix, Source: Bloomberg

Given the stable Chinese growth and improving external condition at this moment, there is less incentive for local authorities to weaken the currency further. Besides, its FX reserves have seen to bottom at US$3 trillions 12 months ago, signaling that the PBOC may have defended this level. China has been actively promoting the yuan internationalism for the past few years, including joining the SDR basket, MSCI EM index inclusion and Bond connect. Therefore, a stable yuan favours the nation’s interest more than a weak one.

While rest of the regional currencies trended higher with yuan, their monetary policy has started to tighten. One of key driver of a dollar appreciation in the period of 2014-2016 was due to policy divergence. When this gap is narrowed in recent months, it trimmed the demand on dollar-buying. Being one of the currencies paying the highest interest rates in the region, demand on Chinese yuan has been increasing since the mid of last year as more inflows flows into mainland China.

Yuan’s impact on dollar are still limited as its influence on most of G-10 currencies is limited. However, China’s supplied-side reform, one of the pillar policies set by top authorities, pushes the domestic raw materials higher. When the local price turned higher, some manufacturers bought raw material overseas instead. As China is the biggest commodity buyer in the world, large amount of purchases easily lifts the commodities’ prices if domestic supplies and productions are “disrupted”. Divergence of its CPI and PPI is also part of a reflection on its supplied-side reform.

Commodities prices determine the inflation trend around the world. Among the major central banks, any ECB’s policy shift seemed to gain the most attention. Euro zone’s inflation rate has been moving closely with the Bloomberg commodity index, hence higher commodities’ prices are seen positive to the single currency, pressuring the dollar lower. On the other hand, dollar tends to have a opposite correlation to commodities in the long term. Thus, higher commodities prices suggest a weaker dollar if all other condition remain the same.

3. Euro Zone –Premature policy tightening seen as ECB may tweak its forward guidance

ECB Vice President Constancio has checked on the euro after its rapid rise of late. Yet, his emphasis on the alignment of the euro's moves and economic fundamentals show jawboning which would only serve to smooth and not reverse the currency's ascent, so long as the Governing Council members acknowledge the region's strong growth dynamics.

ECB is expected to communicate with the market regarding the tightening this year so that a “tightening tantrum” can be avoided. As mentioned earlier, Fed has less policy flexibility after its tightening cycle has lasted more than two years. Without expecting inflation to substantially speed up, pace of tightening may slow down from 2019 onwards and it would be very difficult for the ECB to manage the financial volatilities due to policy shock. We expect ECB to tweak its forward guidance as early as March by hinting that a hike in deposit rate may be necessary if inflation moved towards its 2% target, and stress less on its “for some time after the QE ends”. If rally in bonds yield and currency exceed the ECB’s tolerance level, verbal interventions from time-to-time are well expected. However, these talks are not likely to change the direction of euro, only slowing down the pace.

4. British Pound – “Soft Brexit” a key driver to the future of Pound

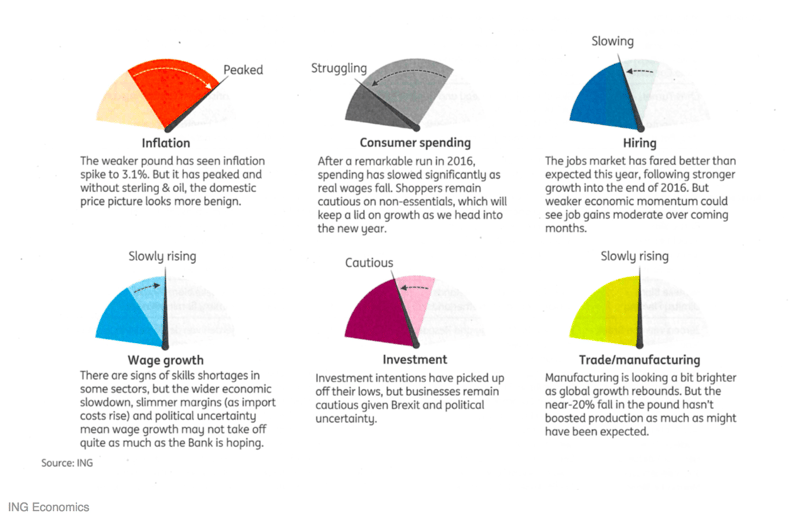

2017 was a good year for UK as the post-referendum recession that has been expected never materialised. Consumers has kept their cool and continued spending accompanied with a global growth which has UK’s growth being expected at a 1.5% for 2017. Looking ahead, 2018 will be a rough year for UK as Brexit uncertainty, high inflation and weak productivity strained on business activity. The Sterling has been on a rise since 2017 and is currently close to pre-Brexit levels.

There are a few reasons why the trend will not be continuing as Pound’s current weakness is making its export competitive accompanied by a recovery in the global economy. BOE will still want to maintain a weak Sterling so as to boost exports which accounts for 32% of its GDP. However, it is vital to know that how the talks go is still a major factor for the direction of Sterling. There was a breakthrough for Brexit in December when the EU declared that “sufficient progress” had been made on citizens’ rights, Britain’s financial obligations and other divorce terms to start negotiating future relations, including trade. In addition, both the Spanish and Dutch Finance Minister has called for a “Soft Brexit”. This can eventually quicken talks and reduce any barriers to Brexit discussions. Lastly, there are rumors that a second referendum is possible which may cause further uncertainty in the Sterling. Nonetheless, Sterling should continue to appreciate as long as negotiations between the EU and the UK remain on track and point to a “soft” Brexit.

The Graphic of Brexit Effect, Source: ING Economics

5. Yen – Hint of tightening from BOJ

2017 has been a relatively good year for Japan as it was the first year BOJ has made no policy moves and maintained its status quo and they have grown for seven straight quarters, which now registers as its longest expansion since the mid-1990s. However, BOJ surprised the market by reducing its bond buying program for the first time since 2016, inching its total assets on its balance sheet down by ¥444 billion ($3.9 billion) from the end of November to ¥521.416 trillion on December 31. This signals that tightening could be on the way for the Japan’s economy.

There are a few things in 2018 that will affect the Yen. Firstly, the new BOJ leadership in March 2018 whereby BOJ will have new deputy governors and in April its new governor. We are not expecting them to drift away from the current policy stance but we should be cautious in any sign of tightening. Another issue will be the planned sales tax rise in 2019 which Mr Abe has reiterated that he would press on with even as the economy is still in the process of recovery. Moreover, the North Korean crisis is a wild card for Japan’s economy as Japan risk military confrontation in the Korean peninsula. Lastly, the Bank of Japan is likely to be the only major central bank to keep rates unchanged even if the economy improves while continuing its quantitative easing program, albeit at a reduced pace. Hence, we should be seeing a weaker Yen for 2018.

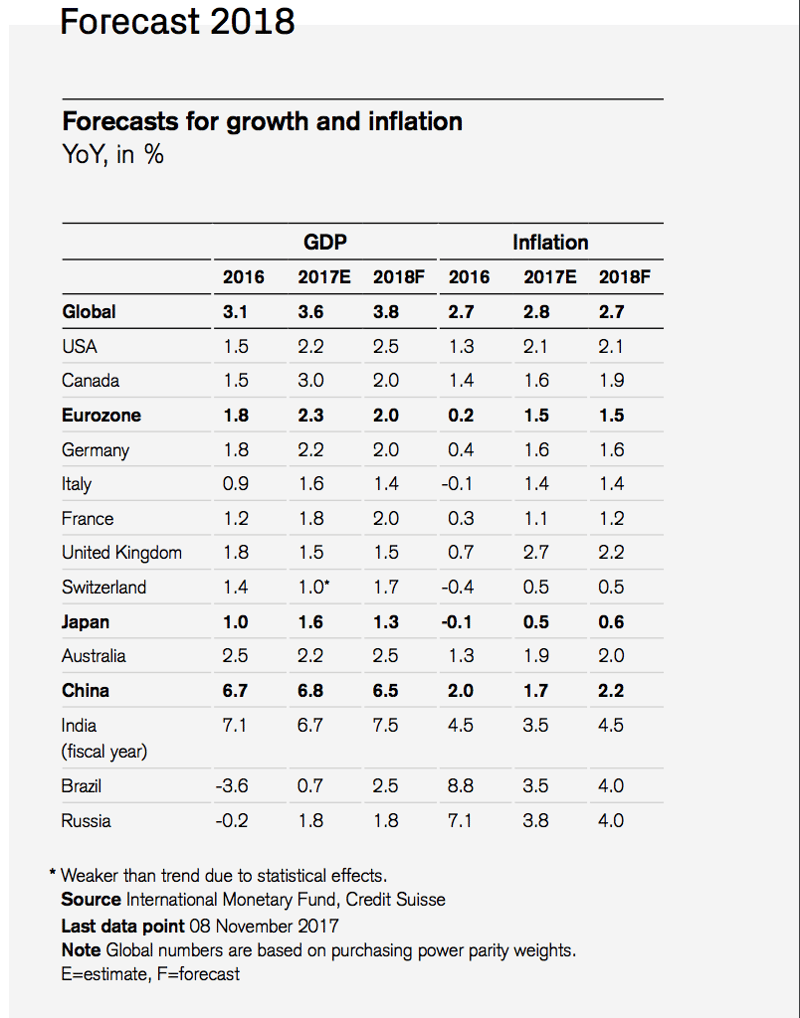

Growth and Inflation Forecast of 2018

Fullerton Markets Research Team

Your Committed Trading Partner