Whether it's behaving like a bull or a bear, the gold market offers high liquidity and excellent opportunities to profit in nearly all environments due to its unique position within the world’s economic and political systems. While many people choose to own the metal outright, speculating through the futures, equity and options markets offers incredible leverage with measured risk.

1. Gold tends to appreciate in low-interest environments

Most of the central banks, except Bank of England, are cutting their interest rates and forecasting more aggressive cuts in the future. During times like this, gold becomes an attractive asset since yield from bonds and savings accounts becomes lower.

2. Gold as a safe-haven asset

Gold is regarded as a safe haven asset, along with assets such as Japanese Yen and Swiss Fran. With the US-China trade conflict continuing to escalate and the stock market in a turmoil, traders could opt for gold to hedge against inflation.

3. Gold is on a long-term uptrend

Investors optimistic about the economic prospects of developing nations such as China and India may see gold investing as a way to profit from this view. Gold has historically played an important role in these countries, and more wealth will likely translate into more demand for gold. With the affluent group growing, the demand for gold will only increase as time goes by.

4. World chaos is good for gold

We are seeing mayhem in many parts of the world at the point of writing. Just to name a few:

1. Hong Kong protests

2. Brexit

3. US-China trade war

4. US-EU trade war

5. North Korea’s missile launches

6. China cutting permits for tourists travelling to Taiwan

All these political and economic crises are only set to worsen and could affect global growth and in turn cause funds to flow to safe haven ahead of the imminent crash.

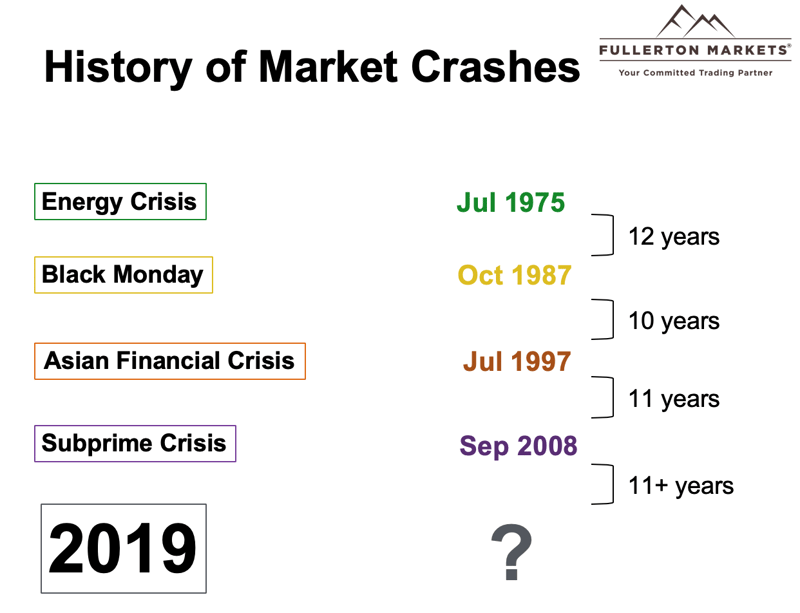

5. A financial crisis usually happens every 10-13 years

The History of Market Crashes

The History of Market Crashes

We are seeing signs of a recession with the spread between 3-month and 10-year Treasury yield inverting to its widest level since 2007 on 4 August 2019. The yield inversion is the market’s favourite recession indicator. A recession will definitely push gold prices even higher towards the 2012 high.

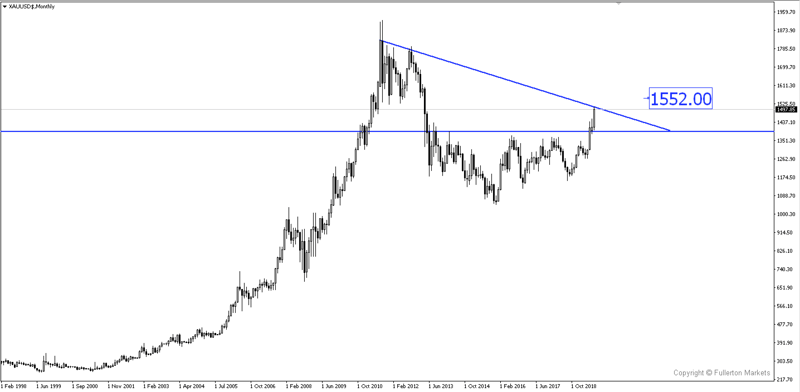

Looking at the XAU/USD chart, we are forecasting price to push higher towards the 1552 price level by the end of 2019.

The XAU/USD Chart

The XAU/USD Chart

Louis Teo

Market Strategist