Personal finance is usually not taught in most schools. This often results in financial illiteracy and young people picking up bad spending and saving habits. And you know what they say about bad habits – they're usually difficult to break.

Most teenagers and college students don’t know what to do with their money except to spend it. Considering that it isn’t guaranteed that you learn money management skills from a young age, it’s totally understandable if you’ve never saved a dime. Nevertheless, there will come a time when you’ll need to boost your money management skills to help you achieve financial freedom.

How and when you choose to start developing good financial habits is up to you. However, it’s highly recommended that you start as early as possible. In case you’re not sure what you can do to change how you manage your funds, here are some of the most important financial habits you can cultivate as a young person.

1. Save Money Regularly

The best time to start saving money is right now. Your first steps toward financial freedom should be setting aside 10% or 20% of each paycheck, regardless of how much you make. As a young adult, there’s a good chance that you’ll have a job that doesn’t pay well.

Instead of spending everything you earn and living from paycheck to paycheck, you can set up a savings account. Avoid keeping money at home as there’s a good chance that you’ll be tempted to spend it sooner or later.

On the other hand, you can set up automatic transfers to your savings account each time you get paid to avoid the temptation to spend that money. Your future self will thank you if you manage to start saving from a young age.

Although all of this sounds simple, it can actually be quite difficult. It’s easy to save a part of your earnings for a few months, but it’ll become harder as more time passes.

This is why it’s imperative that you practise self-control when you decide to start saving. Hopefully, self-control is something you are taught at a young age. If not, you’ll have to figure it out on your own.

From a finance standpoint, self-control is all about making sure that you don’t overspend on things you don’t need. To do this, it’s important to understand the psychology behind shopping and what drives impulsive buying decisions. It’s worth noting that impulse buying is one of the most common financial mistakes young people make today.

There are also other ways to practise self-control, especially for online shopping. For example, you can disable autofill of payment information or abandon your cart before the purchase and come back only if your desire for the product is the same a few days later.

2. Invest Your Earnings

Investing is one of the easiest ways to accumulate wealth, as long as you know what you’re doing. That’s why you should always keep part of your savings in a rainy day fund and invest the rest. Nowadays, it’s easy to find multiple ways to invest your earnings.

For instance, you can try your hand at cryptocurrency trading. Another option is to trade on the foreign exchange (Forex) market. The great thing about both of these options is that they allow you to invest without having to put up a lot of your money.

If you’d like to start trading on the Forex market, all you’d need is $100. The great thing about starting with a small sum is that it’ll allow you to learn and enhance your trading skills with minimal starting capital so that you’ll be able to turn a bigger profit when you start investing more.

Check out this Definitive Guide to Forex Trading for Beginners and the Uninitiated

3. Track Your Expenses

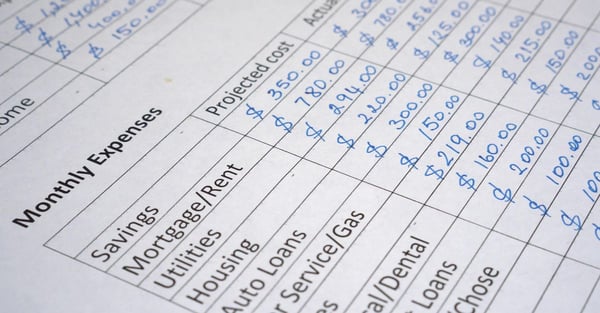

It’s easy to overspend if you aren’t careful. It doesn’t matter if you’re in a grocery store or a bar, you should account for every penny you spend. When you do this for a few months, you’ll find out how much you spend on a monthly basis. Compare your spending to how much you make to get a general idea of what your monthly budget is.

If you regularly spend your paycheck down to the last dollar, you should take a different approach. Write down how much your bills and necessities cost to determine the amount you have left for shopping and other activities.

In other words, you should create a budget that you’ll be able to stick to each month. Keep in mind that your budget should be at most 80% of your earnings. Again, either save or invest the remainder.

4. Get Health Insurance

If you don’t have health insurance and suffer an injury or need to get immediate medical attention because you’re ill, you may end up in debt. No matter what you do, you can never plan for medical emergencies. You’ll save a lot of money and protect your financial freedom if you simply apply for a good health insurance plan.

It’s worth mentioning that treatment for a smaller injury like a broken bone can cost up to several thousand dollars. Say you need medical assistance and the large bills leave you in crippling debt, you’ll likely deal with more stress than you can handle. Because of this, there are some people who refuse potentially life-saving treatment simply because they’re not insured. Either of these two options is really bad, which is why it’s vital that you have health insurance.

5. Earn Extra Money

Earning extra money doesn’t necessarily mean that you’ll have to get another full-time job. There are numerous ways you can make an extra few hundred dollars online. For example, you can start tutoring kids in any subject you are knowledgeable in.

Another option is to start working as a freelancer. If you do this, you’ll be able to set your own working hours. If you’re skilled in writing, design, or coding, it will be easy for you to find a job on freelance platforms. You can also consider generating passive income by starting a website and selling ad space.

You might also want to explore earning potentials of online referral bonus programs. By simply recommending a product to others that will result in a referral sale, you can earn rewards and incentives. Not exactly easy money, but less work than a second job.

Choose to be smart about money

The earlier you develop good financial habits, the more financially stable you’ll be in the future. Sure, this may involve not buying the latest phone or keeping up with all the trends, but whatever sacrifices you make today will pay off big time tomorrow.

Ready to grow your wealth in the world's largest financial market? No better place to start than right here with us! Begin trading with Fullerton Markets today by opening an account:

You might be interested in: Passive Income: What Avenues Are Available to You?