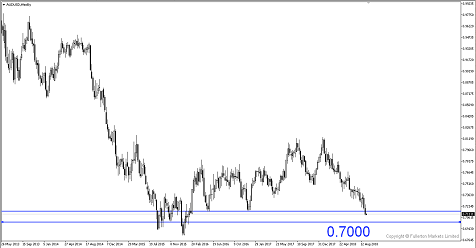

As Trump threatened to impose an additional $267 billion of tariffs on Chinese imports, we could see AUD/USD continuing to fall.

Australian dollar hit a 2-year low last week amid gloomy economic outlook

Australian dollar was the worst performing currency last week followed by New Zealand dollar. This is the first time since February 2016 Australian dollar traded below 71 US cents. We believe that the slide could resume due to 3 reasons:

- President Donald Trump announced additional tariffs on a further $267 billion in Chinese goods last week. This is on top of a $200 billion worth of tariffs that was announced in July which could be imposed any time now. China, being Australia’s main export customer, could mean further volatility ahead for Aussie dollar.

- The out-of-cycle mortgage rate hike in Australia has also dampen property prices, reducing affordability of housing and slowing demand for investors. 3 out of 4 Australia’s four major banks have announced to increase interest rates by 14-16 basis points. This is bound to further exacerbate the decline in prices, impacting housing wealth of all home owners.

- Last week’s NFP has guaranteed a rate hike for US on 26 September and further bolstering bets for a December rate hike. We saw average hourly earnings rise by 0.4% in the prior month, the strongest pace of growth in a year. This added fresh safe haven support to a dollar rally, causing AUD/USD to fall below 71 cents.

This week, Australia will be releasing its jobs report and NAB business confidence data. However, we feel that geopolitics will overshadow economic data. Instead, investors will be focusing on China’s data to see how China has fared amid the trade tensions that is going on. As both US and China do not seem to be willing to compromise on a trade deal, this uncertainty will reinforce Australian dollar’s downside risk.

Our Picks

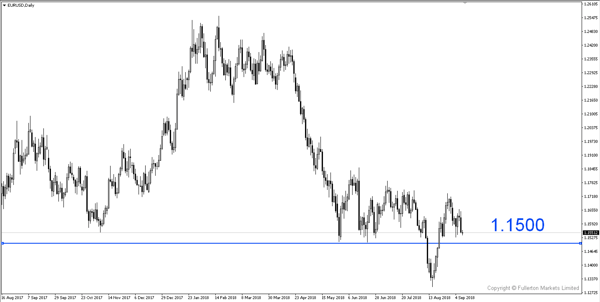

EUR/USD – Slightly Bearish.

This pair may drop towards 1.150 this week as dollar continue to rally amidst the trade tensions.

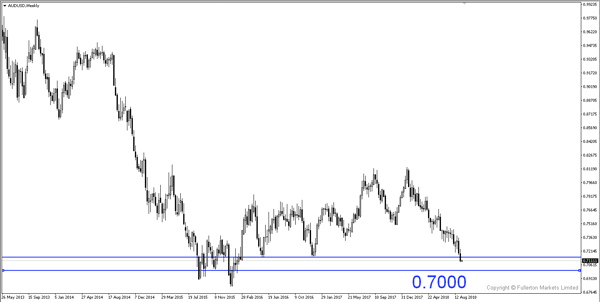

AUD/USD – Slightly Bearish.

This pair has broken to a 2016 low and with the Australia’s outlook still grim, we could see further slides. We expect this pair to drop towards 0.7000.

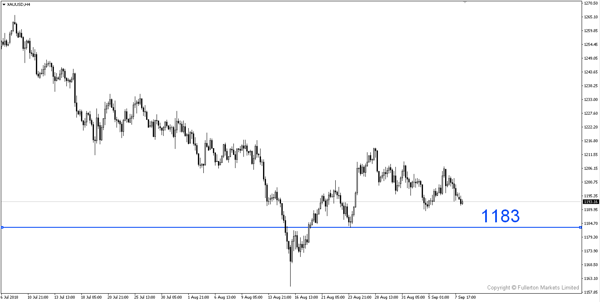

XAU/USD (Gold) – Slightly Bearish.

We expect price to fall towards 1183 this week.

Fullerton Markets Research Team

Your Committed Trading Partner